Greenwich Owners Buying in Greenwich Adds to Covid Buyers

May was a good month for sales in a pandemic. All the late reporting sales are in, and we had 54 sales in May compared with 56 sales for May 2019. The good news is that we have exactly the same 108 contracts this year as last year at this time.

| As of 5/30/2020 |

Inventory |

Contracts |

Last Mo. Solds |

Last Mo Solds+ Contracts |

YTD Solds |

YTD+ Contracts |

Mos Supply |

Mos w/ Contracts |

Last Mo. Annlzd |

| < $600K |

5 |

2 |

2 |

4 |

6 |

8 |

4.2 |

4.1 |

2.5 |

| $600-$800K |

18 |

5 |

3 |

8 |

14 |

19 |

6.4 |

6.2 |

6.0 |

| $800K-$1M |

28 |

6 |

2 |

8 |

13 |

19 |

10.8 |

9.6 |

14.0 |

| $1-$1.5M |

57 |

14 |

14 |

28 |

47 |

61 |

6.1 |

6.1 |

4.1 |

| $1.5-$2M |

73 |

23 |

8 |

31 |

28 |

51 |

13.0 |

9.3 |

9.1 |

| $2-$3M |

122 |

26 |

15 |

41 |

47 |

73 |

13.0 |

10.9 |

8.1 |

| $3-$4M |

95 |

19 |

7 |

26 |

22 |

41 |

21.6 |

15.1 |

13.6 |

| $4-$5M |

46 |

4 |

1 |

5 |

7 |

11 |

32.9 |

27.2 |

46.0 |

| $5-6.5M |

45 |

4 |

1 |

5 |

6 |

10 |

37.5 |

29.3 |

45.0 |

| $6.5-$10M |

48 |

3 |

0 |

3 |

0 |

3 |

– |

104.0 |

– |

| > $10M |

32 |

2 |

1 |

3 |

1 |

3 |

160.0 |

69.3 |

32.0 |

| |

|

|

|

|

|

|

|

|

|

| TOTAL |

569 |

108 |

54 |

162 |

191 |

299 |

14.9 |

12.4 |

10.5 |

May 2020 vs. May 2019

What’s Hot?

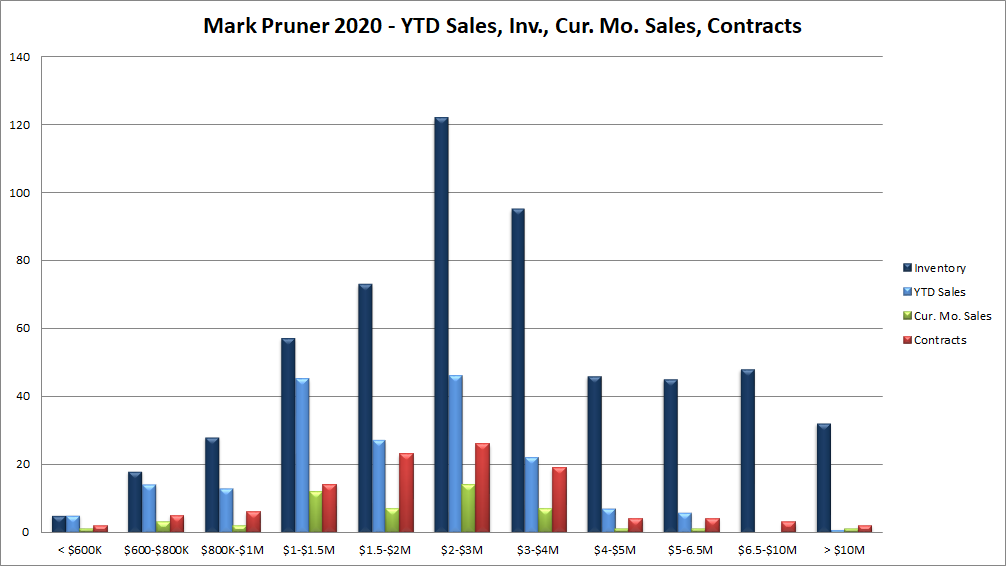

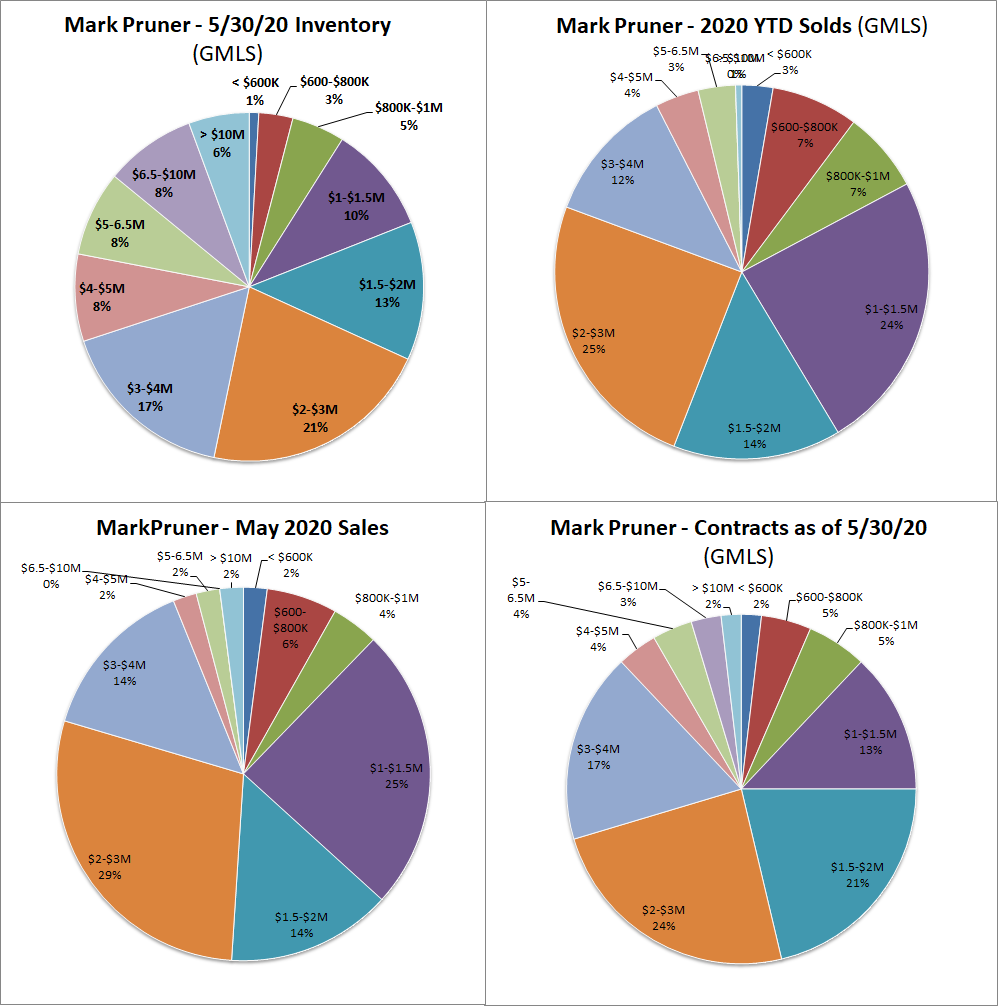

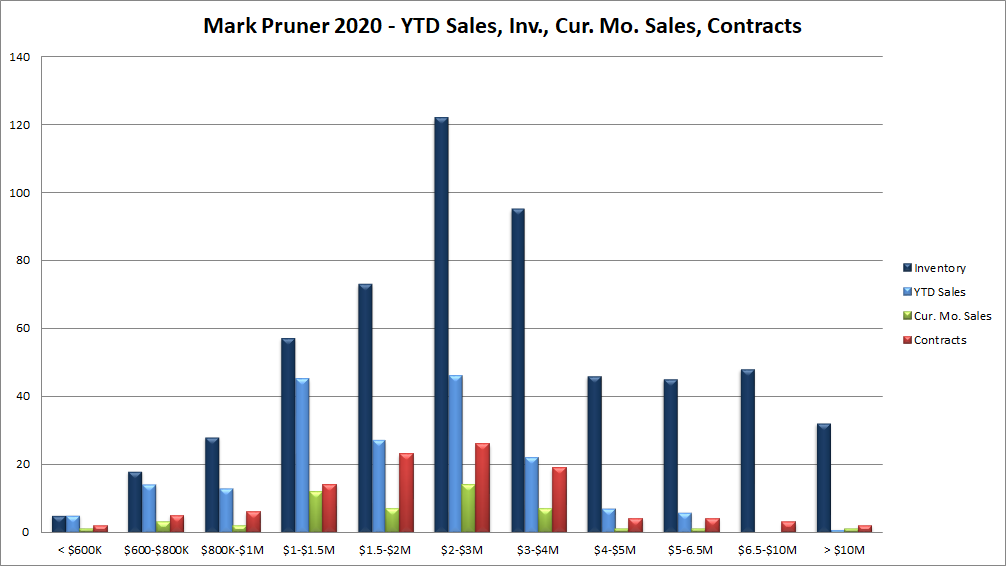

Overall, we have had 186 sales of single family homes this year up 21 sales from 2019 when we had only 165 sales. Our sales are up, or about the same as last year, all the way up to $6.5 million. As noted above sales from $1 – 1.5 million have done particularly well with an increase of 12 sales or a gain of 36% over last year. The other two price ranges that have shown nice gains in sales is the $600 – 800K range where sales are up 56% from 8 sales to 13 sales and also the $5 – 6.5 million price range where sales are up 100% from 3 sales YTD in May 2019 to 6 sales this year.

What’s Not

Anytime you see a big gain in one particular price range you should take a look at the price ranges just above and just below. If all of them are up, you have a strong price trend and you can be reasonably sure that you are seeing a real change in the market year over year. Unfortunately, this is not the case for the $5 – 6.5 million price range. Sales from $4 – 5 million are down 22% from last year from 8 sales to 6 sales.

If you then go the other way and go up in price range, sales from $6.5 to $10 million dollars are down 100% which sounds a lot more dramatic than it is. Down 100% means no sales this year compared to 4 sales last year. We do have 3 contracts waiting to close from $6.5 to 10 million. (BTW: Another issue when numbers are small is just what price ranges are picked and the exact beginning and end of the “month”. I use $6.5 million as a dividing line, because roughly half of our listings between $5 and 10 million are below $6.5 million (45 listings) and half are above $6.5 million (48 listings)).

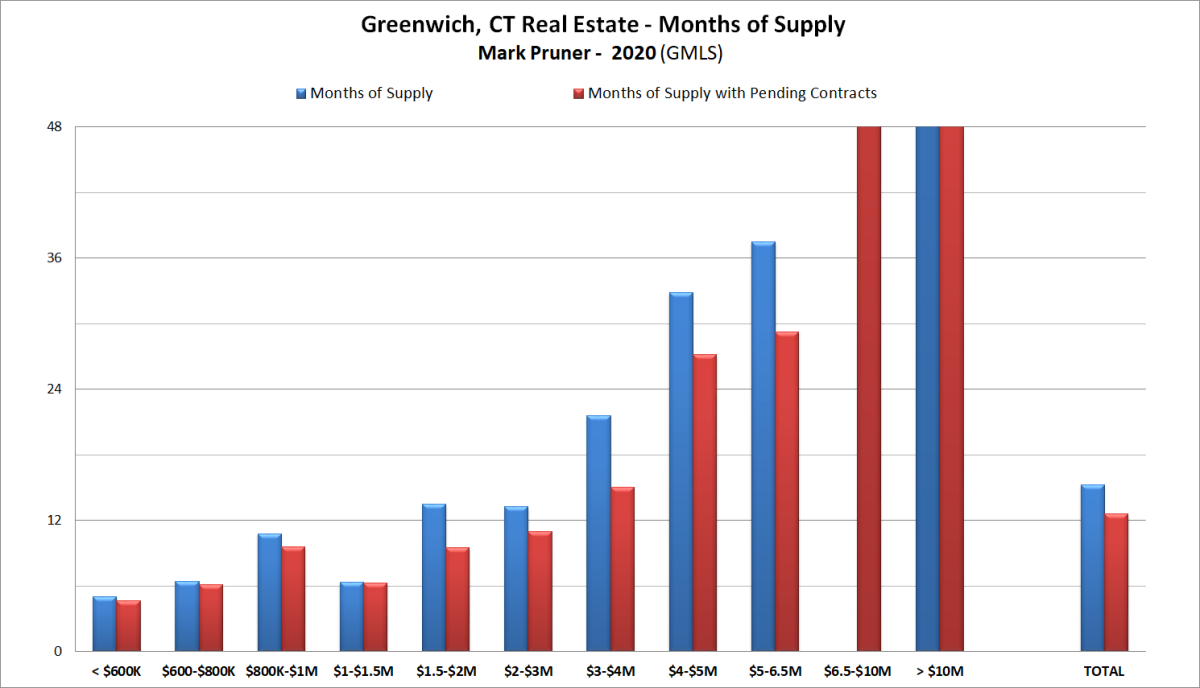

So, is the high-end weak or is it just market segmentation? Unfortunately, the market above $6.5 million is weak as we only have 1 sale so far this year above $6.5 million. The good news is that it is a $17 million sale. We also have a total of 6 contracts above $6.5 million while inventory is down 10% above $6.5 million, Even when you throw in lower inventory and add contracts you are looking at over 8 years of supply from $6.5 million to $10 million and almost 7 year of supply over $10 million. My law of small number does say that a couple of sales and additional contracts will mean a drop of years in the months of supply, but we will need more than a handful of sales for this market segment to start looking healthy.

Why Is the High-End Weak?

The question is why is the high-end is looking weak when we have good activity in the rest of the market. The short answer is no one can say for sure, but I was talking with a couple of other brokers and all three of us kind of felt the same thing. At the high-end people already have a couple of houses and are not seeing the same pressure to “get out of Dodge” as the New York Times called it. The potential high-end buyers already have a nice place outside of Dodge.

The thought among these agents that high-end owners are more able to take a wait and see approach. While the stock market says it’s unlikely to happen, there is some concern about a major depression next year, so low-yield government bonds look better than real estate so high-end buyers are keeping their powder dry.

Are Greenwich Buyers Getting Out Ahead of the Surge?

Overall sales are up 12.7% for the year with most of that increase happening pre-Covid. Post Covid sales are bumpy week by week. The common wisdom is that most of the buyers are families from NYC and we are seeing a lot of that. (I had three buyers referred to me this weekend.) What is interesting though is that I had 5 transaction in May, two sales, two contracts and a rental. In the case of the buyers, all four of them were from Greenwich and all were up-sizers. A couple of other brokers said they were seeing the same thing with Greenwich buyers being a bigger factor in the market in mid-country and backcountry.

Many folks in Greenwich watch the real estate market very closely. Some of our smart, and hopefully prescient, local citizens see this as a window of opportunities for buyers. Mid-country and backcountry have seen declines the last couple of years, but there is a good chance that is turning around this year. For mid-country and backcountry, buyers are getting these houses at last year’s prices and making some good deals. For sellers that are worried about a second great depression, they are flexible on pricing and doing deals now rather than waiting. The result is good sales in a pandemic.

The Greenwich buyers that are out there know what they want and can move quickly when they find it. My listing at 7 Dempsey sold in 11 days from showing to closing on Friday, 5/29, breaking my personal best from the previous week of 12 days from showing to closing.

How COVID Is Changing the Housing Market

We are seeing the trend of buyers looking for more land and social distancing continuing. The other trend that we are seeing are people wanting more on-site amenities. Pools are big, wine cellars are of interest and game rooms are also popular. This might even bring back interest in home theaters, often the least used room in a house.

Condo Sales Up and Down

On the condo side, sales look flat, but it’s because two types of condos are balancing each other out. Sales of townhouse style condos, without shared hallways, are up, while apartment style condos with elevators are down. Covid giveth and Covid taketh when it comes to real estate.

The Coming Surge: More Buyers and More Inventory, Hopefully

It looks like we will be getting our spring market in June and given the large number of folks from NYC looking the market may continue into what is a traditionally a slow August. If many traditional vacation sites are shut down or quarantining, we may see more stay-cations and more buyers house hunting in what would be a slow month. If you are thinking of selling please call me or another agent, we still need more listings, since we are down 23% from last year.