GREENWICH, CONNECTICUT REAL ESTATE

Mark Pruner

INTEGRITY. COMMITMENT. EXPERTISE.

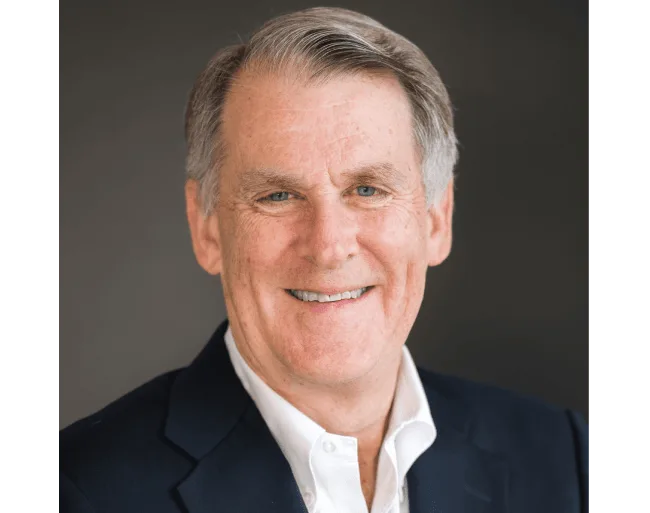

Russell Pruner

LOCAL ROOTS. GLOBAL REACH.

Backed by nearly four decades of experience in Greenwich real estate, Broker Russell Pruner delivers outstanding client experiences and award-winning results. With him at the helm, buyers and sellers enjoy a deeply personal approach to real estate that caters to their unique needs. Elite customer service, unsurpassed market knowledge and, unwavering integrity are the hallmarks of Russell’s work. But it’s his 55-year love affair with Greenwich that makes all the difference. From the Beach Country to the Back Country, Russell is the area’s biggest fan and most avid promoter.

Dena Zarra

Licensed Real Estate Broker

Dena is a wonderful advisor with a proven talent for match making people and homes, suggesting just the right renovations and positioning homes to sell for top dollar. Her clients appreciate her honesty, hard work, creativity, drive, and commitment to getting the deal done. Known for her keen eye for detail and ability to help clients find properties that meet their unique needs and preferences. Dena prides herself on being available to assist her clients at anytime and addressing questions and concerns in a most efficient way.

Timothy Agro

LICENSED REAL ESTATE SALESPERSON

Felipe Dutra Leite

Real Estate Salesperson

Meet Felipe, a dynamic and multicultural real estate professional with an innate passion for understanding people and spaces. Having grown up in Brazil and Belgium and now residing in the United States, Felipe possesses a deep appreciation for diverse cultures and a remarkable ability to connect with individuals from all walks of life.

With a background in media studies and production, Felipe has honed his skills in presenting the finest aspects of people and places. His creative mindset allows him to envision the potential of each property, effectively highlighting its unique features and capturing its essence to attract discerning buyers.

Felipe’s genuine interest in his clients goes beyond the typical real estate transaction. He strives to forge meaningful connections and actively listens to his clients, seeking to understand their distinct perspectives, backgrounds, and motivations. By doing so, he can tailor his approach to meet the specific needs and aspirations of each client.

Why Choose Us as Your Trusted Greenwich Real Estate Partner

Exceptional Market Knowledge – Lifelong Residents – Clients Interests Always Come First

70 Years+

Over $1 Billion

#1 Compass

Members Of:

- National Association of Realtors

- Connecticut Association of Realtors

- Greenwich Association of Realtors

As Seen In

Subscribe to Our Newsletter

Greenwich Streets Podcast

Featured Real Estate Listings in Greenwich

Trusted by Home Buyers & Sellers in Greenwich

WHAT OUR CLIENTS SAY

Dena is a pleasure to work with! I felt 100% confident with her from start to finish in the home buying process. She is very professional and well connected with her many years of experience. I would recommend Dena to anyone looking to buy in the Greenwich/Stamford area - no one knows the area better than her! She really listens to her clients and went above and beyond my expectations. If you are buying ...WHAT OUR CLIENTS SAY

I would highly recommend Dena. She is extremely knowledgeable in the Greenwich market and such an asset to have on your side. She responds quickly all around which is a positive attribute to help get the home you want.WHAT OUR CLIENTS SAY

Russ was the absolute perfect agent for us to work with, and so I can very strongly recommend it. As first-time home buyers, we did a ton of research, talked with family members, and tried to understand everything we could go into the process, but from day 1 all the way through closing Russ made everything so much easier and better than I could have imagined. He knows the Greenwich or Riverside market do...Work With Top Greenwich Real Estate Experts

We are a dedicated group of Greenwich natives. We have a deep passion for our hometown and enjoy everything the town offers its residents from the beach front to the backcountry. That is why we don’t find you just any home, we find you the right home.