Similar Markets with Remarkable Differences

You might think that with the common issues of high demand and low inventory facing the luxury markets in all the high-end towns in Westchester and Fairfield County, that the market in each town would be similar. However, we see large differences among these towns, all of whom have median sold prices over $1 million.

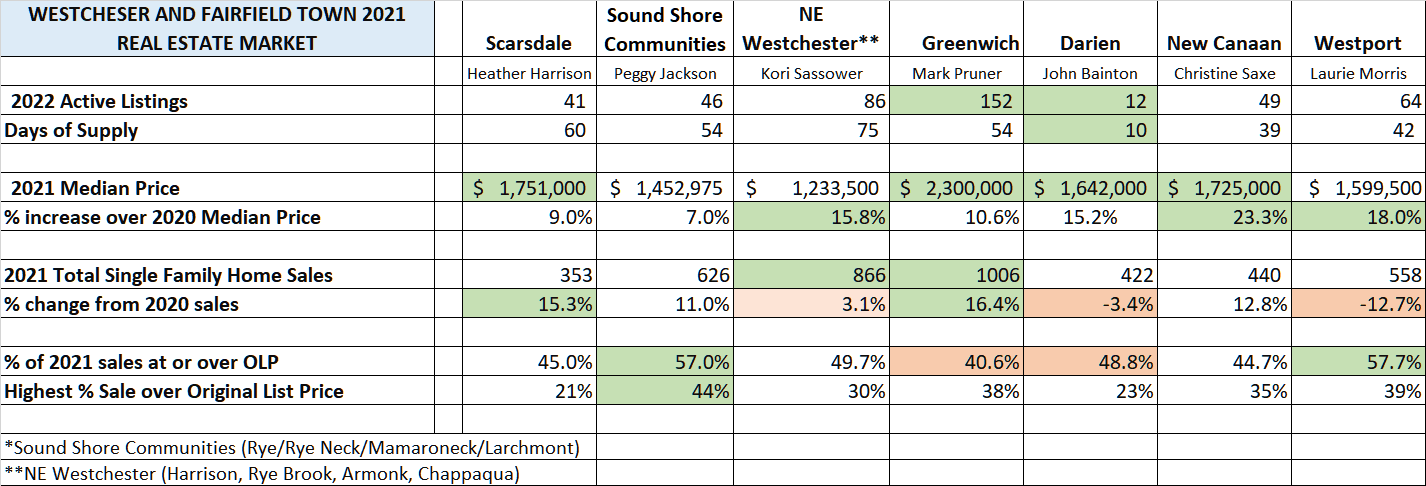

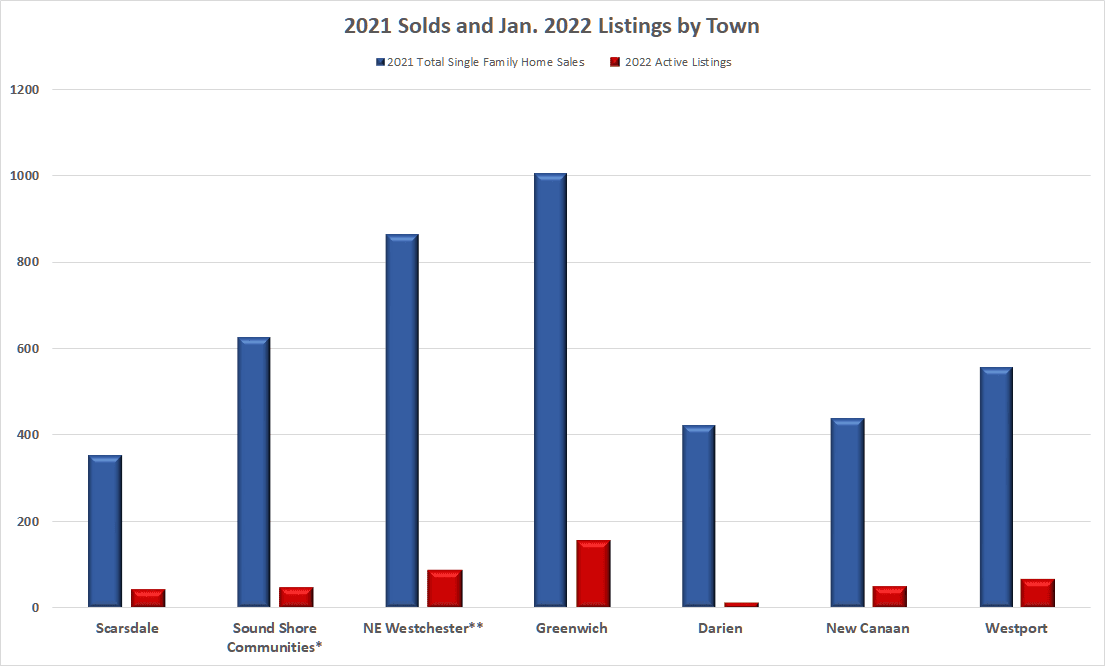

We have been bemoaning our lack of inventory of inventory in Greenwich all year, but compared to Darien, we have a major surplus of inventory. We have 152 listings on the market, Darien has 12 single family homes on the market which works out to 10 days of supply.

We also have marveled at how many of our houses have gone for full list price or over list but among the high-end towns in Westchester and Fairfield County we’re actually at the bottom with only 41% of our listings going for full list price or over list. Compare this to the Sound Shore Communities in Westchester County. In Larchmont, Mamaroneck, Rye and Rye Brook 57% of the houses sold for list or over list with one of them actually going for 44% over the initial asking price.

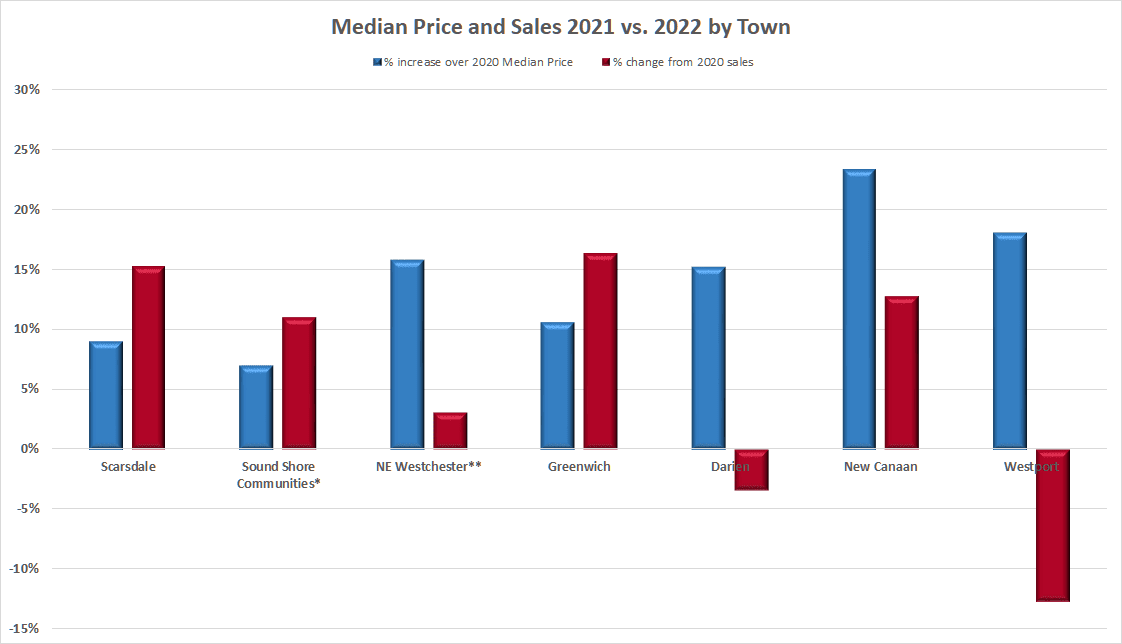

We were quite pleased with our 11% median sales price appreciation, however, Westport had 18% price appreciation. The one place where we clearly were the leader is our 16% sales growth in the number of single-family homes sold in 2021 compared to 2020. We had 1,006 sales compared to last year’s 864 sales: more about this later.

Similar Issues

Across the country, COVID has initiated the reshaping of the housing market. The pandemic led to a huge increase in work from home and the associated increase in the demand for larger homes. For most of 2020 and 2021, we saw extraordinarily low interest rates that kept monthly mortgage payments low. Less talked about is the run up in the stock market and it’s effect on housing demand. There’s nothing like having a bunch of gains in your stock portfolio to make you think that now might be a good time to buy a house and reallocate some assets, in case the stock market goes down.

Inflation has also encouraged house buyers to move assets from cash that is devaluing into hard assets that are appreciating. They also want to buy, before prices go up further. We’ve seen a jump in sales in December and the first part of this month as mortgage rates go up, presaging the Fed’s announced interest rate increase in March.

The common wisdom is that increased interest rates slow the economy and over a long enough period of time that’s certainly true, particularly if you sharply increase interest rates in a short time. However, in the short term, the anticipation of increased interest rates and the initial portion of rising rates only drives sales as people move to quickly buy before interest rates go even higher. We’ve certainly seen that in last two months as what is normally a very slow holiday season in December saw lots of people out looking and that has continued, and even heightened, in the new year.

Inventory, Supply & Demand

For towns that had inventory in 2021, we saw big jumps in sales. For towns that didn’t have inventory, sales dropped or just inched up over 2020. Westport and Darien actually saw the number of single-family home sales drop in 2021 compared to 2020. In Westport, sales were down a remarkable 13%, but this drop was due to insufficient supply, not low demand. The biggest drop in sales also resulted in the biggest jump in median price, up 18% in Westport to $1,599,500 last year. Where inventory was the lowest relative to demand, we saw prices go up the most.

New Canaan was the one exception to lower sales, higher prices. In New Canaan, prices increased by 23% and sales increased by 13%. The price increase bumped their median price to $1,725,000 and sales to 440 sales, not bad for a town of less than 20,000 people.

It’s gotten so bad that months of supply don’t really tell the story; we are now looking at days of supply. New Canaan, with only 49 active listings has only 39 days of supply at last year’s torrid sales price, it will be interesting to see what happens this year. In Connecticut, Greenwich also saw nice increases in sales numbers and median prices, just not to New Canaan’s level. Both these towns have the highest median price with a fair number of houses at the very high end. While sales at the high-end jumped last year, we still had good inventory to keep the sales numbers chugging along.

When you look at the Westchester towns, Scarsdale and the Sound Shore Communities of Rye, Rye Neck, Mamaroneck and Larchmont all had double digit increases in their 2021 sales numbers and single digit increases in their 2021 median price. They also had; well, you really couldn’t call it good, but certainly better days of supply than in other towns. Scarsdale and the Sound Shore Communities have 60 and 54 days of supply.

Northeast Westchester, which includes the towns of Rye Brook, Harrison, Armonk and Chappaqua, our nearest Westchester neighbors, saw a big jump up in median price, which was directly related to a small increase in the number of sales caused by very limited inventory. What’s curious is that the two area in each county that are the furthest from New York City, Northeast Westchester in NY and Westport in CT, are the ones that saw the least growth in sales.

It looks like Northeast Westchester, Darien and Westport all saw major saw major increases in 2020 which wiped out much of the shadow inventory. Also, the work from home movement meant that these towns were less inconvenient, i.e, they had shorter weekly commuting times as people no longer commuting every day. As a result, these areas were more attractive to more buyers.

List, Over-List and Multiple Offers

Throughout all the towns, we saw houses going for full list or over list from 41% in Greenwich to 58% in Westport and 57% in the Sound Shore Communities of Westchester. Demand is not easily is not easily quantifiable, but these numbers show that the demand is out there. Every agent I’ve talked to, has stories of new houses coming on the market and getting anywhere from 25 to 70 appointments in the first couple of days. You hear stories of having so many offers that the only way to keep track of them is with a spreadsheet.

Clearly, there is lots of demand and at the lower price levels under $1,000,000 or even $1,500,000 is where competition is the fiercest. In Greenwich, we only have 14 listings under $1.0M, and only 6 more, if you go up to $1.5M. From $1.5M to $2.0M, there are eleven more listings for a total of 31 listings under $2,000,000. We see similar shortages of affordable houses throughout the area.

Inventory VS. New Listings in a Hot Market

Today’s hot housing market is driven by new listings. Looking solely at inventory can be a little deceptive for two reasons. First many new never get counted as active inventory in monthly report and certainly not in the quarterly report. You don’t get to 1006 sales in Greenwich or 866 sales in Northeast Westchester without a significant number of new listings coming on and going off.

Greenwich, with its 152 listings, stands out among all of the towns. Greenwich is more like a small city with multiple neighborhoods, multiple price ranges, a population of over 63,000 people and 22,000 plus housing units. Even with these 152 listings at the present pace of sales seen last year, we only have 54 days of supply which is similar to most of Westchester. East of Greenwich, the days of supply drop. Westport has 42 days of supply; New Canaan has 39 days and Darien only has 10 days of supply.

Now, this days of supply does not mean that we are going to run out of houses to sell. New listings will come on to replace sales and even in this market houses that are priced above market rate and particularly, if they need work, can still be tough sales.

Over $5 million, even newer houses can stay on the market for a while. Our median year built for all sales in 2021 was 1961. The median year built for houses that are active on the market over $5 million is 2004 and the median days on market 240 days or 8 months. Our market at the high end, and particularly those high-end houses in back country and midcountry are doing much better than in 2019, but over $10,000,000 we are still looking at 13.7 months of supply. This is the same price category that only a couple of years ago we were looking at months of supply measured in years.

What’s the new year going to bring?

The short answer is I don’t know, and I tend to be concerned about anybody who says that they do know. If we assume that interest rates are going to go up, we should have a short burst of sales. Presently we have 29 sales in the middle of January and our ten-year average for January is 35 so despite this incredibly low inventory we will very likely be above our 10-year average for sales by the end of the month. If interest rates increase significantly, they may well cut into sales as our lower inventory is doing now. Increasing interest rates will also likely switch some money from stocks to bonds, potentially resulting in lower demand for stock and hence lower stock prices. Higher interest rates will also push down bond prices lessening the wealth effect.

With stock prices down, bond prices down and interest rates up, you would expect that demand will drop, however interest rates are likely to below particularly compared to inflation. Even some softening in buyer demand is unlikely to result in a major correction given the lifestyle shift caused by work from home which looks to persist even after the pandemic.

On the flip side, after two torrid years of sales, lots of folks who had been thinking about downsizing or upsizing may have already done so. Downsizers often move out of the area or switch from houses to condos, while upsizers are more of a zero-sum game. Their purchase of a larger houses reduces inventory, but their sale of their older house adds a listing back to inventory.

Also, a thank you to my fellow Compass agents,

Heather Harrison in Scarsdale,

Peggy Jackson in the Sound Shore Communities,

Kori Sassower in NE Westchester,

John Bainton in Darien,

Christine Saxe in New Canaan,

Laurie Morris in Westport and

Michael Ferraro online for their statistics and insights in their markets. I, however, am responsible for any misstatements, mischaracterizations or just bad conclusions. Lastly, we can never discount, the black swan events and the emotions of the market.

Stay tuned it’s going to be a fascinating market.