High-End Sales Have an Excellent Month

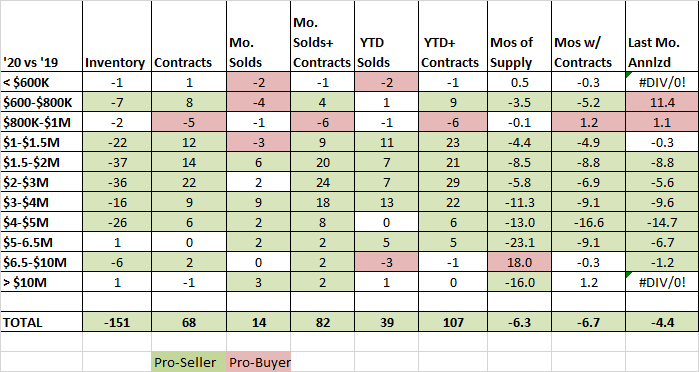

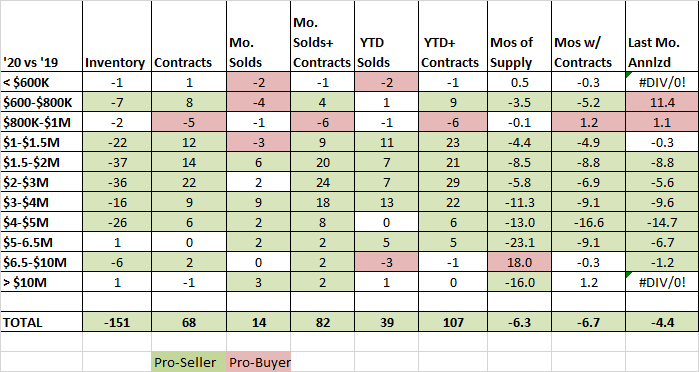

At the end of May we had 299 sales and contracts, then June came along and sales and contracts surged to 436 houses sold or under contract; an increase of 50% in one month. The story at the upper end is even more dramatic. Above $3 million we went from 68 sales and contracts at the end of May to 117 sales and contracts in June, an increase of 72%. By far our most dramatic jump was closed high-end sales over $5 million which are up 286% in just one month, but more about that later.

The growth in these sales and contracts continue to escalate. Back in the week beginning May 4th we only 23 transactions, then it was 33 and 43 in a week. We dropped back to 33 transaction for the 4-day week of Memorial Day. The next week we jumped to 53 transactions as made up for the 4 day prior week. Then 44, 48 and 52 transactions. This week, once again only a 4-day week, we had an amazing 62 transactions.

This dramatic jump in sales is being driven by three factors. By far the largest is the continued flood of Covid buyers from New York City, who primarily fall into two categories. Most of these buyers are younger families who are looking in the $1 – 2.3 million range. These buyers have been cooped up in a New York City apartment, often with multiple children. More square footage, a yard, parks, and beaches look pretty attractive to them.

A second less obvious sub-group of Covid-motivated buyers from New York City are newlyweds and DINKs. Pre-Covid, couples that met in New York City would move in to whichever person had the nicer apartment and live there until the first or second child came along. I’ve showed houses to lots of couples where the wife is pregnant and wants to be settled in a new place before the baby is born. In the meantime, they would live in New York City enjoying all of the restaurants, cultural activities, and nightlife that NYC is so famous for. In the Covid era, all those activities are either gone or still dangerous to enjoy. As a result, many couples are skipping the NYC, Dual-Income-No-Kids period and moving directly to Greenwich. I’m working with three couples just like that.

|

As of 7/2/2020

|

Inventory

|

Contracts

|

Last Mo. Solds

|

Last Month Solds+ Contracts

|

YTD Solds

|

YTD+ Contracts

|

Months of Supply

|

MoS w/ Contracts

|

Last Mo. MoS Annlzd

|

| < $600K |

5 |

3 |

0 |

3 |

6 |

9 |

5.0 |

4.2 |

#DIV/0! |

| $600-$800K |

16 |

12 |

1 |

13 |

15 |

27 |

6.4 |

4.4 |

16.0 |

| $800K-$1M |

30 |

9 |

4 |

13 |

17 |

26 |

10.6 |

8.7 |

7.5 |

| $1-$1.5M |

57 |

25 |

9 |

34 |

56 |

81 |

6.1 |

5.3 |

6.3 |

| $1.5-$2M |

77 |

30 |

14 |

44 |

42 |

72 |

11.0 |

8.0 |

5.5 |

| $2-$3M |

118 |

45 |

12 |

57 |

59 |

104 |

12.0 |

8.5 |

9.8 |

| $3-$4M |

91 |

24 |

16 |

40 |

38 |

62 |

14.4 |

11.0 |

5.7 |

| $4-$5M |

45 |

11 |

5 |

16 |

12 |

23 |

22.5 |

14.7 |

9.0 |

| $5-6.5M |

53 |

6 |

5 |

11 |

11 |

17 |

28.9 |

23.4 |

10.6 |

| $6.5-$10M |

50 |

4 |

5 |

9 |

5 |

9 |

60.0 |

41.7 |

10.0 |

| > $10M |

36 |

2 |

3 |

5 |

4 |

6 |

54.0 |

45.0 |

12.0 |

| |

|

|

|

|

|

|

|

|

|

| TOTAL |

578 |

171 |

74 |

245 |

265 |

436 |

13.1 |

9.9 |

7.8 |

The second big group that is increasing sales in Greenwich are Greenwich homeowners and renters that are upsizing. Our Greenwich residents that have been waiting for the post-recession market to turn are seeing it and getting out ahead of ever-expanding market demand. Right now, most houses are priced at 2019 and pre-Covid 2020 prices. Greenwich buyers have another month or two to enjoy these prices. After that, we are going to see the closing prices of our 171 contracts. Many of these contracts, were signed after bidding wars involving multiple buyers and the contract prices are over the list price.

Indicative of this hot market is that in June, 32 of the new listings never made it to their one month anniversary. When we find out the sales price after closing, these prices are going to start the price resetting process. Another sign of a hot market is that our average days on market for sales and contracts jumped from 149 DOM last year to 183 DOM this year. Of the 171 contracts we have signed as the end of June, 7 were actually on the market for more than 1,000 days and 27 were on the market for a year. When the stale inventory is selling you know it’s time to get moving if you need a house.

The third thing that is driving high-end Greenwich market in June is the state’s new Gold Coast conveyance tax. Last year the Connecticut legislature increased the conveyance tax on sales over $2.5 million by 1% effective July 1, 2020. Of the 124 sales in CT over $2.5 million so far this year only 11 were outside of Fairfield County. Within Fairfield County near all the sales were in Greenwich, New Canaan, Darien and Westport.

The July 1st effective date of the $2.5M+ tax meant we saw a lot of deals that would have closed in July and August get pushed up to June. On a $10 million dollar sale, the seller would save $75,000 by closing on June 30th rather than July 1st. This was all the motivation many high-end buyers needed to closer sooner. As I mentioned above, sales above $5 million were up 286%. We went from 7 sales over $5 million at the end of May to 19 sales at the end of June. Of the 12 sales in June over $5 million, 7 of them over $7 million compared to only 1 sale over $7 million in the first 5 months or an increase of 600%.

We had 2 sales over $10 million occur on June 30th and 2 sales from $5 – 10 million on that date out of 11 sales. Unfortunately, this also means that July will likely be a poor month for high-end sales as the June accelerated deals aren’t there for a July closing. Right now, we have 12 contracts for houses listed over $5 million, all of whom will be helping to fund the Connecticut treasury by paying the higher conveyance tax.

One of the fun things to do is take these high-end June sales and annualize them. When you do that our months of supply over $10 million drops from 54 months of supply to 12 months of supply. From $6.5 – 10 million the drop in months of sales is from 60 months, or 5 years of supply, to 10 months of supply. Would that we could keep these June sales rate up all year round. Even with our present sales rate, things are still looking up for future sales over $3 million. When you include contracts over $3 million our months of supply is lower than when you only look at sales. This indicates an improving market though we may have to wait until August to see the number of sales increase.

On the inventory side we are still down 21% from last year, but fortunately we are seeing lots more inventory come on the market, particularly in backcountry and mid-country where we need new listings. I just put on 14 Gray Oaks Lane for $3.65 million and it has been getting good interest as mid-country seems to be the new sweet spot in the Covid-era, not too far from town, but with good acreage for outdoor activities and social distancing.

14 Gray Oaks Lane, 5 BRs, 5 BAs, 2.28 Ac, $3.65M

Our 74 June house sales were better than June 2019, when we had 60 sales and a better month than June 2018 when we had 66 sales. We still have a ways to go to reach our 10 year average of 86 June sales, but the trend is definitely in the right direction.