Last week we looked at the overall Greenwich real estate market and the thing that stood out the most was the dramatic drop in inventory. At a time when inventory should be picking up, we are looking at the same number of listings that you see at the end of winter. This week we only have 523 single family home listings, up 2% from last week, but down 25% from last year.

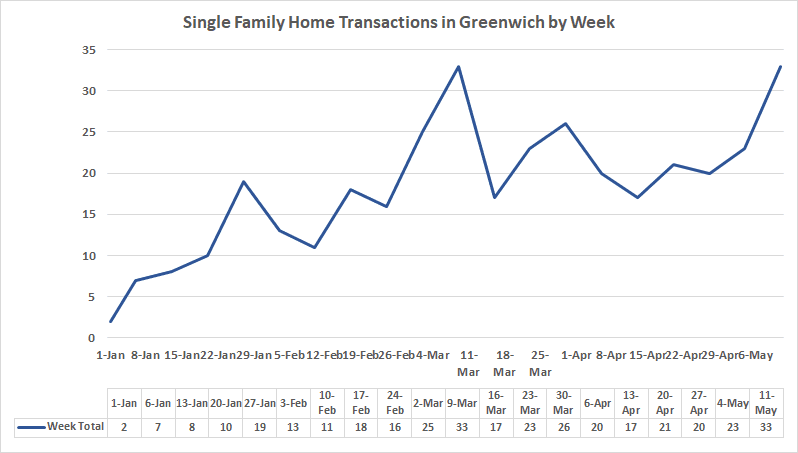

This week, what stands out is the dramatic jump in transactions. We are seeing more buyers in the market and as I said before, anyone that is looking to buy a house in a pandemic is a motivated buyer. Our showing are still down, but our transactions continue to increase. Last week we had 23 transactions; (sales and contracts) up from 20 transactions the previous week.

This week we saw are sharp acceleration in transactions with 33 sales and contracts. On Tuesday I had two showings and a lease got signed. During the week, I’ve had multiple inquiries on listings on which clients had already accepted offers. Most of the agents that I speak with say they are busy but deals in a pandemic can be both harder and more difficult and sometimes easier. For the cash buyer deals can go very quickly. My backcountry land deal closed on Friday 12 days from the first showing, which is a record quick closing for a residential sale for me.

On the other hand, deals involving mortgages are getting more difficult. Some of the big national banks have tightened up their lending requirements. Wells Fargo had already dropped their loan to value ratio last year in Fairfield County. (This is a problem of a big national bank who treats New Fairfield, the same a Milford ,and the same as Greenwich. Counties are about as granular as they can get. ) Other regional and local banks continue to lend, so it’s an important time to have a good mortgage broker who can steer you to the bank and the product that is best suited for your situation.

Single Family Home Sales and Contracts in Greenwich, CT as of 5/14/20

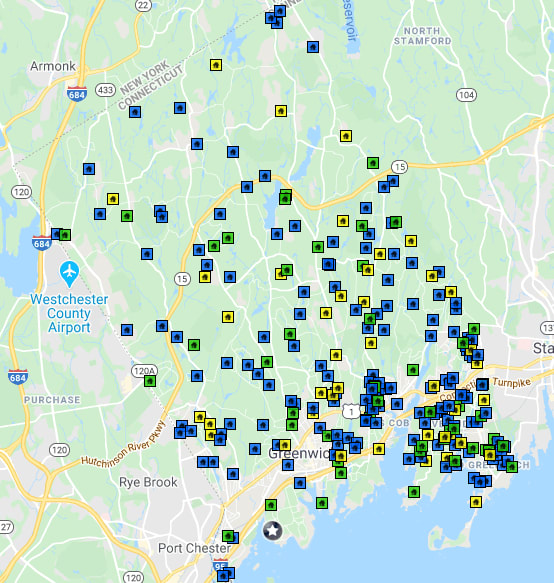

Sales blue, pending contracts yellow, contingent contracts green

Our biggest sale of the year, 54 Byram Drive in Belle Haven just sold for $17 million. Up until this week our highest sale had been $6.5 million at 19 Brookridge, so this sale was very welcome news. We also have two other listings at $13.9 million and $8.6 million waiting to close. Our high-end market is slow, because these folks already have another home that they can go to. I’ve heard of apartment buildings in New York City that are two-thirds empty as people go to their vacation home, their kid’s place or even their mother-in-law’s place. (Of course, it helps to have a nice mother-in-law as I do.).

The Neighborhoods

|

April 2020

Section

|

Inventory

|

Sum of List Prices

|

DOM

|

Number sold

|

Mos of Supply

|

Sum of Sold Price

|

|

Byram

|

8 |

$ 9,708,300 |

122 |

2 |

16.0 |

$ 4,425,000

|

|

Cos Cob

|

47 |

$ 78,115,900

|

227 |

15 |

12.5 |

$ 17,445,500

|

|

Glenville

|

22 |

$ 26,182,900

|

223 |

5 |

17.6 |

$ 5,598,000

|

|

North Parkway

|

81 |

$ 421,512,500

|

369 |

13 |

24.9 |

$ 27,272,500

|

|

Old Greenwich

|

57 |

$ 151,015,999

|

138 |

25 |

9.1 |

$ 50,390,356

|

|

Pemberwick

|

4 |

$ 3,194,000

|

91 |

3

|

5.3

|

$ 1,935,000

|

|

Riverside

|

57 |

$ 232,792,500

|

189 |

17 |

13.4 |

$ 36,897,500

|

|

South of Post Road

|

63 |

$ 424,962,500

|

283 |

12 |

21.0 |

$ 24,825,000

|

|

South Parkway

|

171 |

$ 755,941,400

|

296 |

41 |

16.7 |

$ 107,784,198

|

|

Grand Total

|

513 |

$ 2,108,249,749

|

262 |

135

|

15.2 |

$ 278,278,054

|

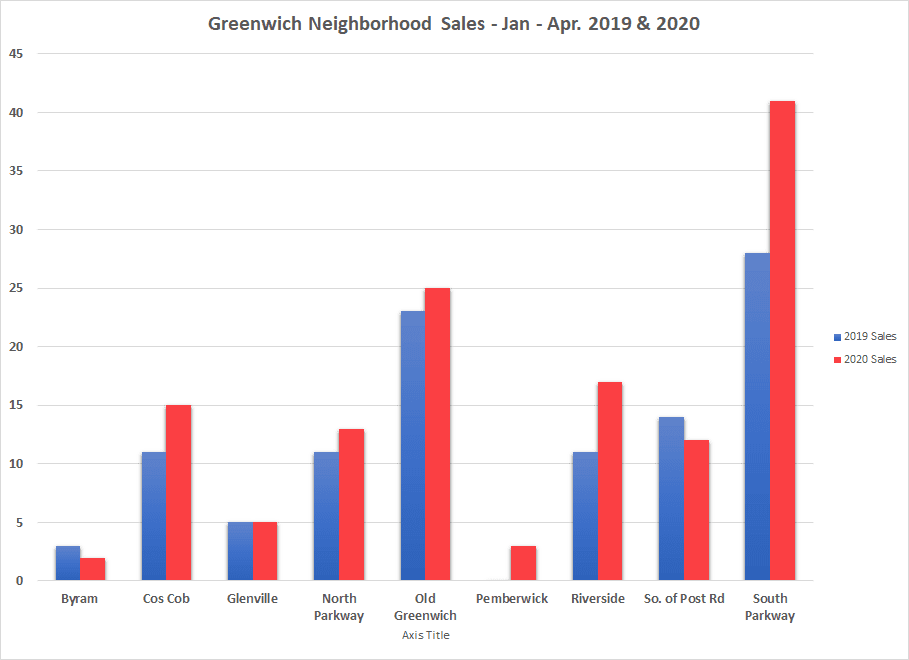

Backcountry

Last year backcountry Greenwich had a good year with sales up 30%. Its percentage sales increase was even greater than Old Greenwich. Most of this growth was focused in the $1 – 3 million range as young families looked at what they could get in Riverside or OG and what they could get in backcountry and a bunch decided having 4 acres was really nice.

This streak is continuing for backcountry this year as sales in the first third of the year are up 18% to 13 sales from 11 sales last year. I expect that backcountry will continue to do well as post-Covid people are going to want even more land. At the same time listings in backcountry are down 26%. I’ve got all three of my listings in contract. So if you live in backcountry and are thinking of selling please give me or another agent a call, we need more houses to sell and the buyers are out there.

Mid-Country

The place we are really seeing an increase in sales is “South of the Parkway” as the GMLS calls mid-country and all the way down to the Post Road. There sales are up 46% from 28 sales in the first third of 2019 to 41 sales this year. For those folks that want land, but don’t want to be too far from town, mid-country may be it.

|

April 2020

Section

|

Inventory

|

Sum of List Prices

|

DOM

|

Number sold

|

Mos of Supply

|

Sum of Sold Price

|

|

Byram

|

-4

|

$ (24,717,100)

|

-37

|

-1

|

0.0

|

$ 2,636,000

|

|

Cos Cob

|

-6

|

$ (6,520,099)

|

31

|

4

|

-6.8

|

$ 1,320,650

|

|

Glenville

|

-4

|

$ (18,984,100)

|

27

|

0

|

-3.2

|

$ 917,000

|

|

North Parkway

|

-28

|

$ (133,096,382)

|

-18

|

2

|

-14.7

|

$ (22,764,850)

|

|

Old Greenwich

|

-29

|

$ (70,459,501)

|

-35

|

2

|

-5.9

|

$ (7,670,804)

|

|

Pemberwick

|

-2

|

$ (2,388,000)

|

-72

|

3

|

5.3

|

$ 1,935,000

|

|

Riverside

|

-26

|

$ (14,151,590)

|

0

|

6

|

-16.8

|

$ 14,209,678

|

|

South of Post Road

|

-6

|

$ 11,503,500

|

106

|

-2

|

1.3

|

$ (14,262,600)

|

|

South Parkway

|

-69

|

$ (285,053,421)

|

27

|

13

|

-17.6

|

$ 29,189,160

|

|

Grand Total

|

-180

|

$ (552,713,942)

|

27

|

135

|

-10.5

|

$ 5,559,234

|

Riverside & Old Greenwich

Last year, Riverside was in the doldrums, while its sister neighborhood, Old Greenwich was up. This year sales in OG are up 9%, while sales in Riverside are up 54%, albeit off a smaller base. Riverside went from 11 sales in 2019 to 17 sales in the first third of 2020. Old Greenwich, on the other hand, had a very respectable 23 sales in the first four months of 2019 and gained 2 sales to 25 sales through the end of April this year.

Pemberwick & Byram

The southwest section of town traditionally does well, because it is where you find our best values and where you have seen some of our greatest appreciation since our last revaluation in 2015, they also are small areas. We’ve seen a combined 5 sales here so far this year, which is up 2 houses from last year. What folks in this part of town are likely to see next year is a big jump in taxes as their increased values mean they will be a bigger part of the Grand List will likely take on a bigger share of the town’s budget obligations.

Cos Cob

Cos Cob is neighborhood, where I spend lots of holidays at my brother’s house. It had the greatest fall in sales last year. Partly, this was due to robust growth in prior years. This year sales are back with a 36% increase over a bad 2019. So far, we’ve seen 15 sales in Cos Cob up from 11 sales in the first 4 months of 2019.

Summary

Overall, our average sales price is down from $2.52 million to a paltry $2.06 million or a drop of 18%. (Of course, most towns aspire to be this paltry.) But don’t panic, the large drop in the average sales price is mostly due to poor sales at the high-end. We are going to see big changes this year, it all depends on just how long the virus hangs around. We’ve got a good chance at having a very good year as a few million New Yorkers try to jam into our fair town. The question is will they have enough money if the economy doesn’t recover quickly.