Plus, the Mid-November Greenwich Market Update

Greenwich R.E. Market Update

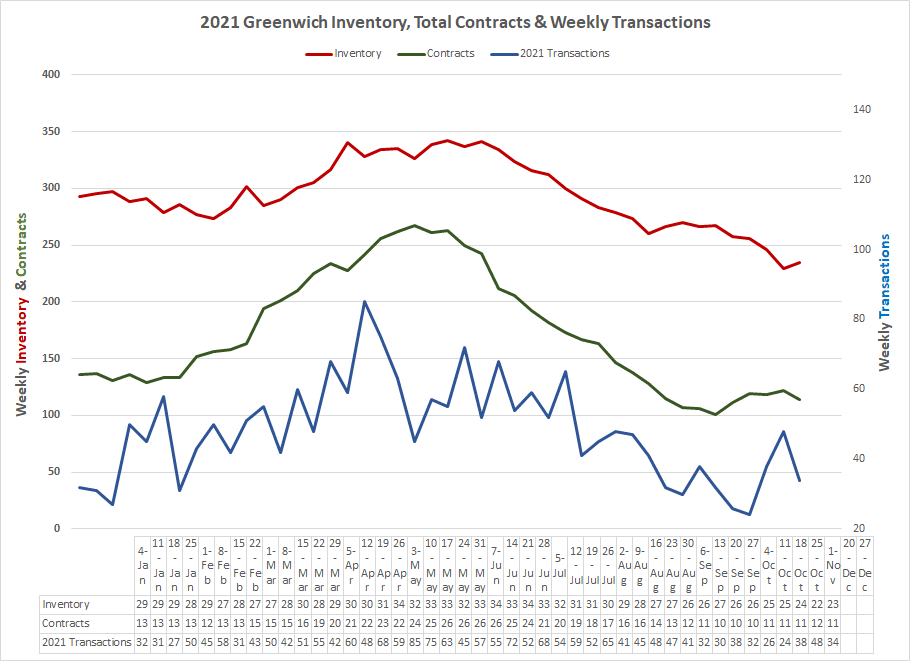

If we did not sell another house this year, 2021 would still be our best year for sales ever. As of mid-week, we have sold 905 single-family homes. Add in the 111 contracts that are waiting to close and you have 1,016 transactions so far this year. We need another 95 sales this year to reach 1,000 sales in Greenwich and there are some weekly indicators that we may make it.

Inventory

Our real estate engine has been running on less than half of a tank of gas all year. Our highest inventory level all year was only 342 listings in the first week of June. We then slid steadily down to only 229 listings in the last week of October. The fear was that this five-month’s slide would continue, and our market would essentially die.

The good news is that our inventory has ticked up by 6 listings at the end of last week to 235 listings and as of the middle of this week we added 3 more houses to the listing. Now 9 listings may not seem like a lot, but what it does is take a declining line and actually turn it up a tiny bit. Our inventory normally drops as we approach the year-end holidays, but the normal year’s low was this year’s high.

Contracts & Transactions

We have also seen contracts recently turn up from a low of 101 contracts at the end of September to 111 contracts in the first week of November. Our contracts rose throughout October as our fall market inventory, what there was of it, made a bunch of new houses available for sale. In this market, if we have new inventory, we have new sales.

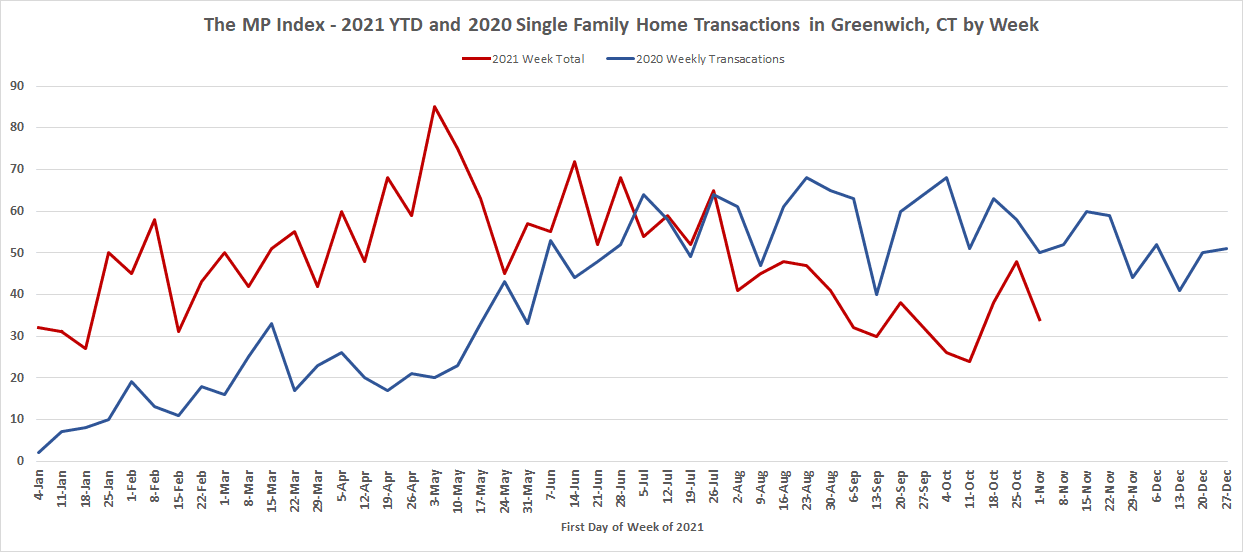

As a result, we saw a spurt in weekly transactions, the total of contracts, and sales that week. To me, transactions are the best indicator of how active our market is. However, transactions aren’t quite as straightforward a number as the phrase, weekly contracts plus sales might seem. Contracts come in two types according to FlexMLS, the software service for the Greenwich MLS. You have contingent contracts and pending contracts.

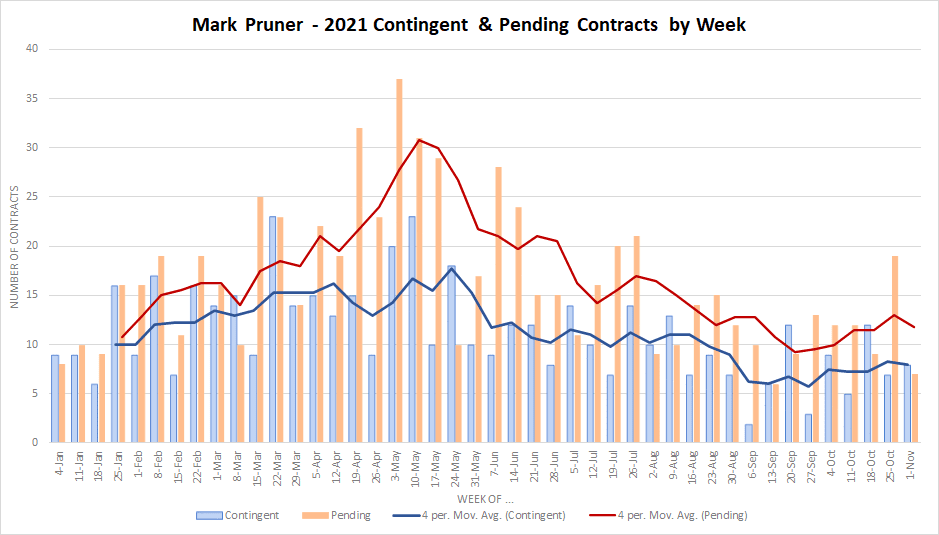

Most contingent contracts become pending contracts once the bank makes a mortgage commitment. As a result contingent contracts are counted twice in the transaction numbers, however, getting contingencies removed is another sign of market momentum. In a slow market, more buyers exercise their contingency and cancel the purchase contract. A rise in pending contracts indicates not only more people doing all-cash deals, but also more people moving forward or what were contingent contracts.

Negotiating the Contingent Contract Offer

Contingent contracts mean that that buyer has an out. (NB: Most of the time a contingent contract is contingent on the bank making a mortgage commitment, but there are a wide variety of other types of contingencies, such as land use approval contingencies; neighborhood association approval contingency, a Hubbard clause where the buyer has to sell their present house before closing on their new house, and many other types of contingencies.)

If the buyer can’t get a mortgage, they have the right to exercise the mortgage contingency and terminate the contract. The seller’s attorney then returns the buyer’s 10% deposit. Of the 876 single-family home sales in Greenwich through the end of October 2021, 499 or 57% of the contracts had contingencies, the large majority of which were mortgage contingencies.

Sometimes a contract will have more than one contingency. Back in the 80s when I worked as a real estate attorney, it was common practice for their to be two contingencies. The first contingency was an inspection contingency for a week to ten days, followed by a mortgage contingency of 30 to 60 days. This meant that once the contract was signed, the buyer was in control of the deal. If there was something they didn’t like in the inspection, they could call the deal off. More commonly, the buyer would ask the seller to reduce the price or to make repairs.

Sellers weren’t big on losing control of the deal for their house, so unlike many other places, the Greenwich standard is that the buyer has to do the inspection before the seller’s attorney even starts to draft the contract. If the seller gets a better offer while the inspection is being done or the contract is negotiated, they are free to accept it. This gives either party the ability to back out of the “deal”.

Some sellers are of the old school and a deal is a deal and they won’t accept the higher offer. Even so, the higher backup offer puts tremendous pressure on the first buyer to accept the house ‘as is” regardless of what the inspection turns up. On the flip side, the seller who accepts a second higher offer runs the risk of losing both deals.

If the second buyer does an inspection and decides there are problems, they can back out. If the second buyer backs out, the seller has to go back to the first buyer hat in hand and ask them to go through with their original offer. Often the first buyer has found another place, or they tell the seller to take a flying leap out of pure pique.

One thing, the seller can do to lessen the first buyer’s irritation at being gazumped, as the British call it, is for the seller to offer to pay the buyer’s inspection cost and any other reasonable expenses that they incurred. If the seller does that, it’s reasonable for the seller to ask for a copy of the inspection, since they are paying for it, which often comes in very handy. Be aware that many inspectors consider the inspection to be only for that particular buyer.

Once the contract is signed, the prevailing buyer needs to work closely with their mortgage broker or banker to make sure that every “i” is dotted and every “t” is crossed. In this market, you don’t want to be asking for an extension on the contingency.

Contingent and Pending Contracts

This year contingent contracts have remained fairly steady throughout the year, while pending contracts took a jump up in the middle of April and really took off in May, June, and even into July. This period, which I call the “Frenzy” had lots of contracts being signed at all price levels, leading to an all-time record sales month with 143 single-family home sales in July 2021.

This was also the period where $5 million dollar houses were flying off the market just like $1 million listings. If you annualized June sales from $5- 6.5 million we had 2.5 “instantaneous” months of supply, while from $1.5 – 2.0 million we had 3.2 months of supply based on annualized sales. The more expensive the house, the more likely, there will not be a mortgage contingency.