Our market is like a car running on a quarter tank of gas and we are not sure where the next filling station is. Our gas tank/inventory continues to remain very low and in November it gained some net listings at the beginning of the month only to drop a little more by end of the month. Luckily, we seem to have a Herbie, the Love Bug type of market. It doesn’t need a lot of gas to move really fast. Even though our inventory was way down to another record low by the end of November, our sales were up in November 30% compared to the prior month and some of the sales were spectacular.

|

Inventory as of 12/1/21

|

Inventory

|

Contracts

|

Last Mo. Solds

|

Last Month Solds+ Contracts

|

YTD Solds

|

YTD+ Contracts

|

Months of Supply

|

MoS w/ Contracts

|

Last Mo. MoS Annlzd

|

|

< $600K

|

2

|

0

|

0

|

0

|

8

|

8

|

2.8

|

3.1

|

#Div/o

|

|

$600-$800K

|

9

|

5

|

2

|

7

|

37

|

42

|

2.7

|

2.7

|

4.5

|

|

$800K-$1M

|

7

|

11

|

5

|

16

|

56

|

67

|

1.4

|

1.3

|

1.4

|

|

$1-$1.5M

|

18

|

18

|

7

|

25

|

147

|

165

|

1.3

|

1.4

|

2.6

|

|

$1.5-$2M

|

21

|

15

|

7

|

22

|

127

|

142

|

1.8

|

1.8

|

3.0

|

|

$2-$3M

|

30

|

28

|

13

|

41

|

231

|

259

|

1.4

|

1.4

|

2.3

|

|

$3-$4M

|

29

|

19

|

6

|

25

|

136

|

155

|

2.3

|

2.3

|

4.8

|

|

$4-$5M

|

21

|

9

|

6

|

15

|

64

|

73

|

3.6

|

3.6

|

3.5

|

|

$5-6.5M

|

25

|

4

|

5

|

9

|

61

|

65

|

4.5

|

4.8

|

5.0

|

|

$6.5-$10M

|

27

|

8

|

3

|

11

|

54

|

62

|

5.5

|

5.4

|

9.0

|

|

> $10M

|

19

|

4

|

2

|

6

|

12

|

16

|

17.4

|

14.8

|

9.5

|

|

Total

|

208

|

121

|

56

|

177

|

933

|

1054

|

2.5

|

2.5

|

3.7

|

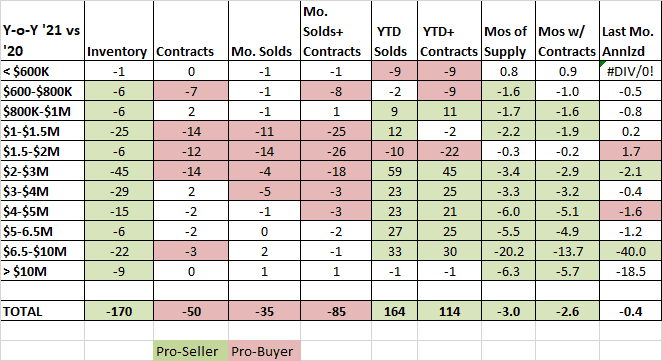

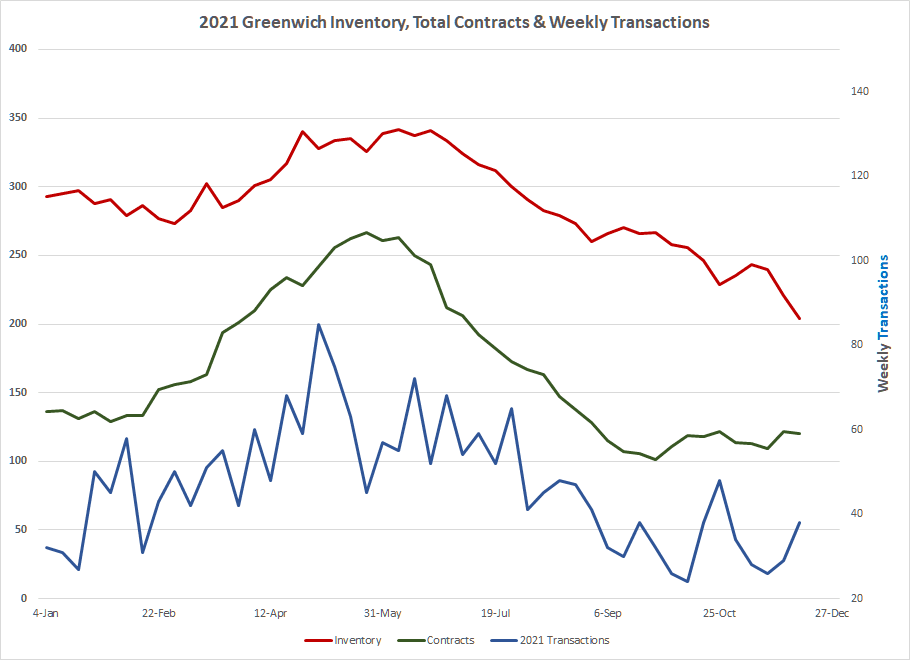

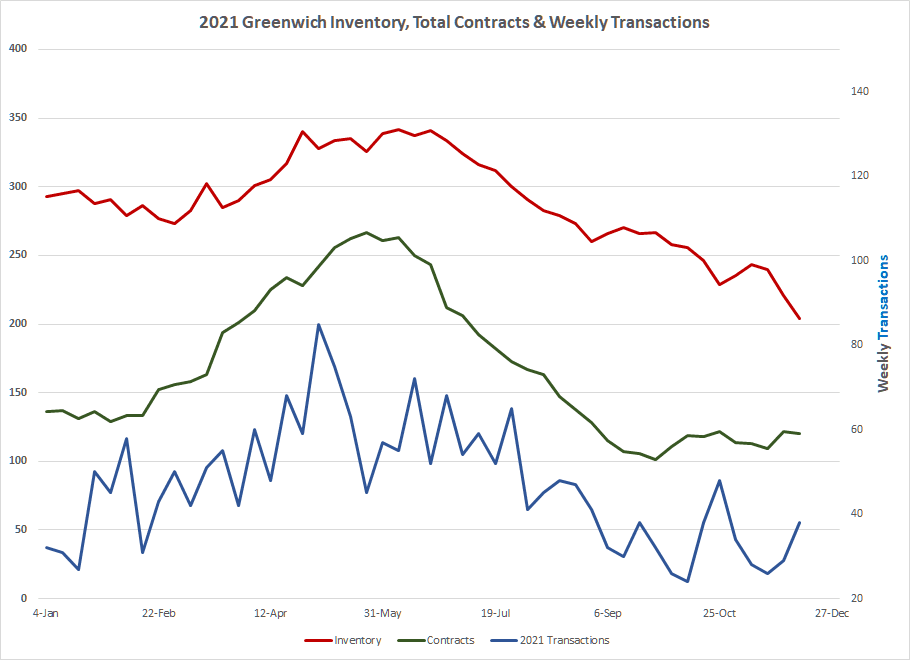

For the year, out inventory peaked at 342 single-family-home listings in June. In a normal year, we should have peaked around 700 listings in May. After our June peak, which was really like more like a low hillock, our listings dropped for the next 4 months, down to 229 listings by the last week of October.

November 2021 vs. November 2020

Fortunately, the slide stopped in early November and inventory rose slightly to 243 listings in the first part of November. Increasing inventory meant that for the first time in 4 months, listings were coming on faster than properties were going to contract. By the end of November, the spurt in contracts and sales in November meant that we started the first day of December with only 208 listings.

For the year, the number of outstanding contracts followed the same pattern as inventory. Contracts rose steadily from the beginning of the year and by June we peaked at 263 contracts. After that, the number of outstanding contracts dropped steadily until there were only 101 contracts by the end of September. This is a fairly typical seasonal pattern, just shifted a month forward. Part of this shifting was the result of the Covid vaccines kicking in March which meant more buyer activity just delayed a month. As a result, contracts peaked in June rather than May as in most years.

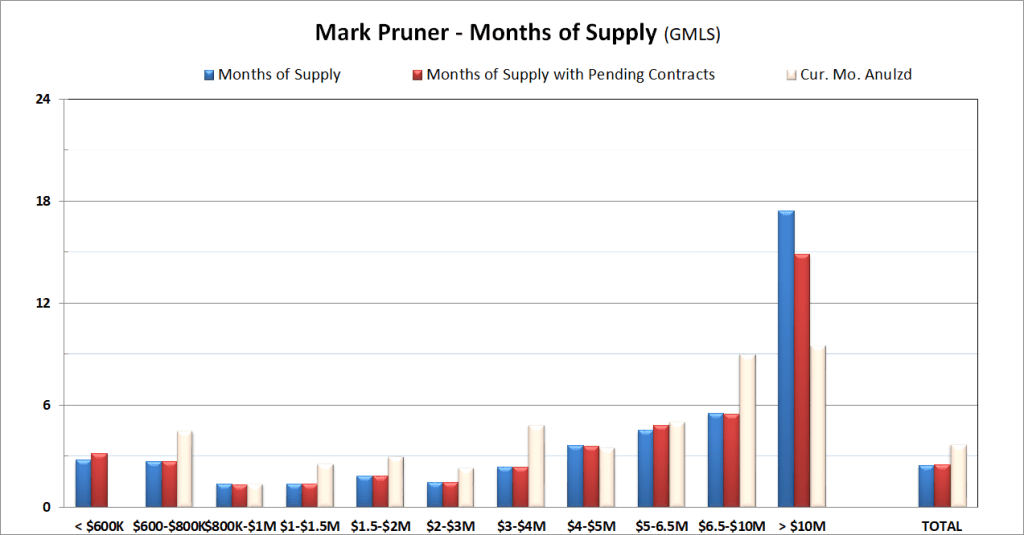

Last month’s uptick in listings led to an immediate increase in sales. In November 2021, we had the aforementioned 56 sales compared to our 10-year average of 43 sales. What’s remarkable is that we are doing this with very low, and often stale, inventory. This late in the year 77% of the inventory has been on the market for more than two months and 20% has been on for more than 9 months. We only have 26 “fresh” listings that have been on for less than a month, which is only 13% of the market. Any properties, under $10 million priced to market, that are in good shape will have a contract in the first two months and probably the first two weeks.

Part of the low inventory is that my brother Russ and I, and I’m sure other brokers, were pausing new listings until after the Thanksgiving holidays. I expect a bunch of new listings this week. If listings stay up, our sales will continue to grow as older listings are generating buyers’ interest. I’ve got a backcountry contemporary that has been on for 6 months and needs updating. The seller has come down in price and we’ve had 5 showings in the past week with one and possibly two offers coming in next week when folks get back from extended Thanksgiving vacations. We still have lots of buyers and if we had more inventory, we’d have lots more sales. Our median sales price is now $2.3M compared to $1.87 million at the end of 2019 or an increase of 23% in two years.

Some folks have argued that people are abandoning the New York metro area. Clearly, folks from Greenwich and NY Metro area are moving to Florida and other warmer climes, but we’ve always had that. Post-recession, the movement from Greenwich to the South slowed as people waited for house prices to recover after the Great Recession. All the owners of this “shadow inventory” have now sold with many moving south, though, not necessarily full time. The downtown condo market, a classic location for Greenwich downsizers and snowbirds is very tight as our Geenwich sellers want a foot in their hometown and their warmer clime.

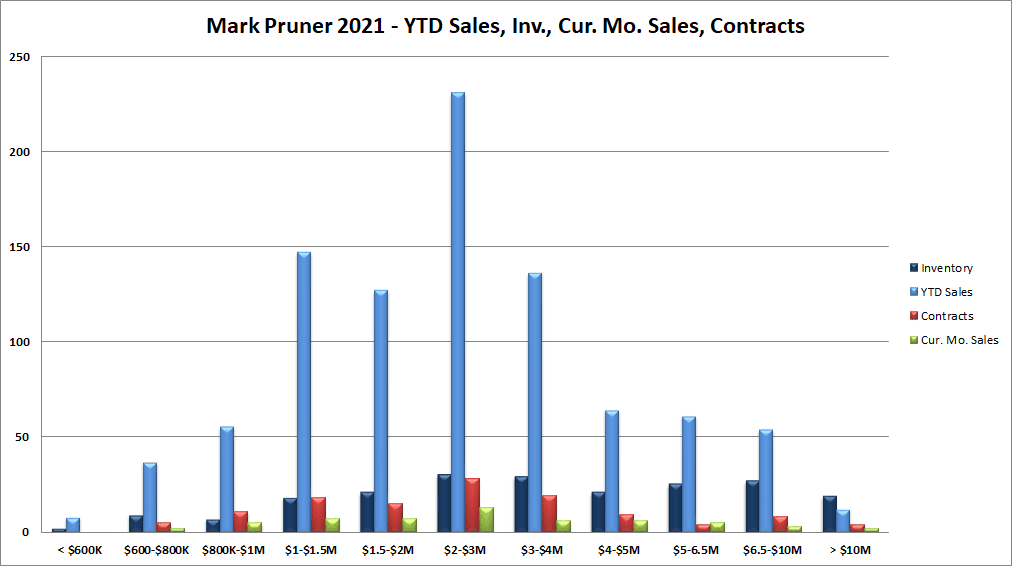

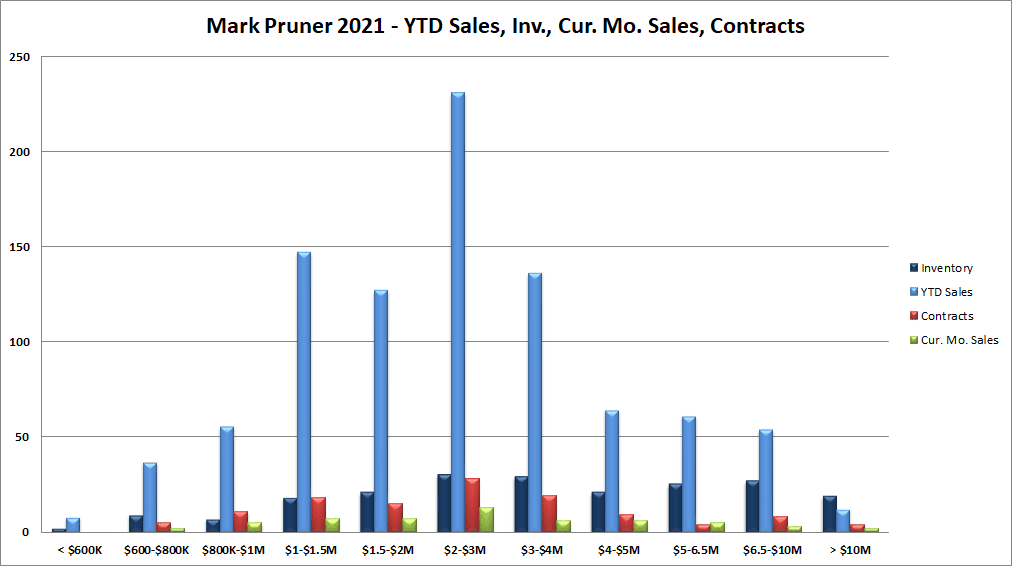

I also think a bunch of people have accelerated their retirement and relocation plans because of Covid and listed their houses earlier than they might have without the pandemic. This has been great for our market, as we needed a record amounts of new listings to get a record number of sales. Our 863 sales of single-family homes in 2020 was an all-time annual sales record. That record was eclipsed by October 23rd of this year. Each subsequent sale this year sets a new record. As of December 1 of this year, we are up to 933 sales.

We had a bunch of high-end sales in November, but we are not done. We have 4 properties under contract that are listed over $10M and 16 contracts for listings over $5M waiting to close. For successful young families and downsizers looking in the $1 – 4M price range they are finding a fierce market. Our inventory in that price range is down 105 listings from what was an already low inventory last year. The result is that our sales for November 2021 are down 34 sales from November 2020.

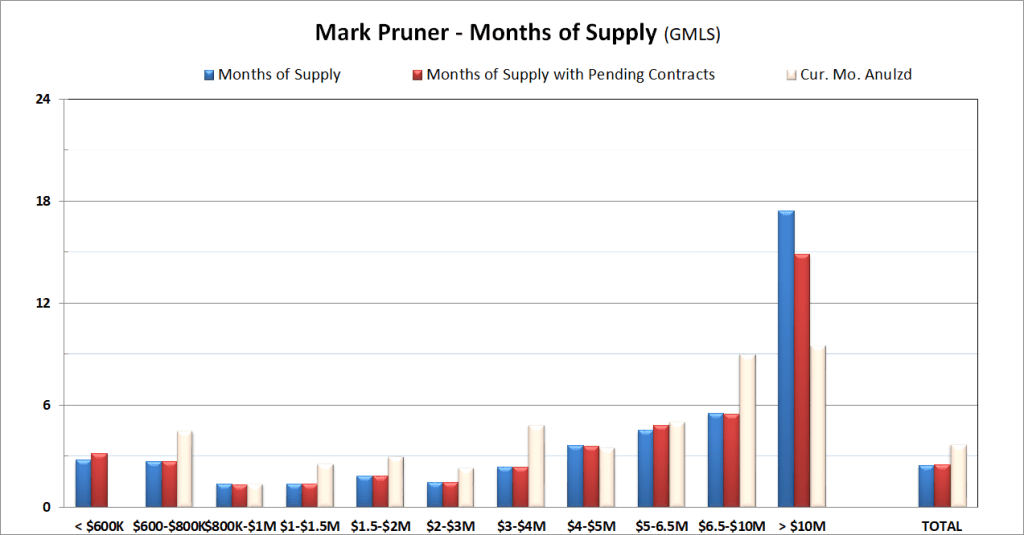

For the year, we are still up in sales for every price range from $800,000 to $10 million, with the glaring exception of $1.5 – 2.0 million. In that price range, our sales have dropped 10 sales from 137 sales in the first 11 months of last year to 127 sales through November this year. Our months of supply for that price range dropped from 2.2 months of supply to only 1.8 months of supply this year. Of course, buyers in that price ranges should be glad that they are not trying to buy a house from $800K – $1M. In that price range you have 7 listings and 1.3 months of supply.

Overall, it’s an interesting time to be in the market. It is one of the few Decembers where we are telling folks that it is a good time to list a house.