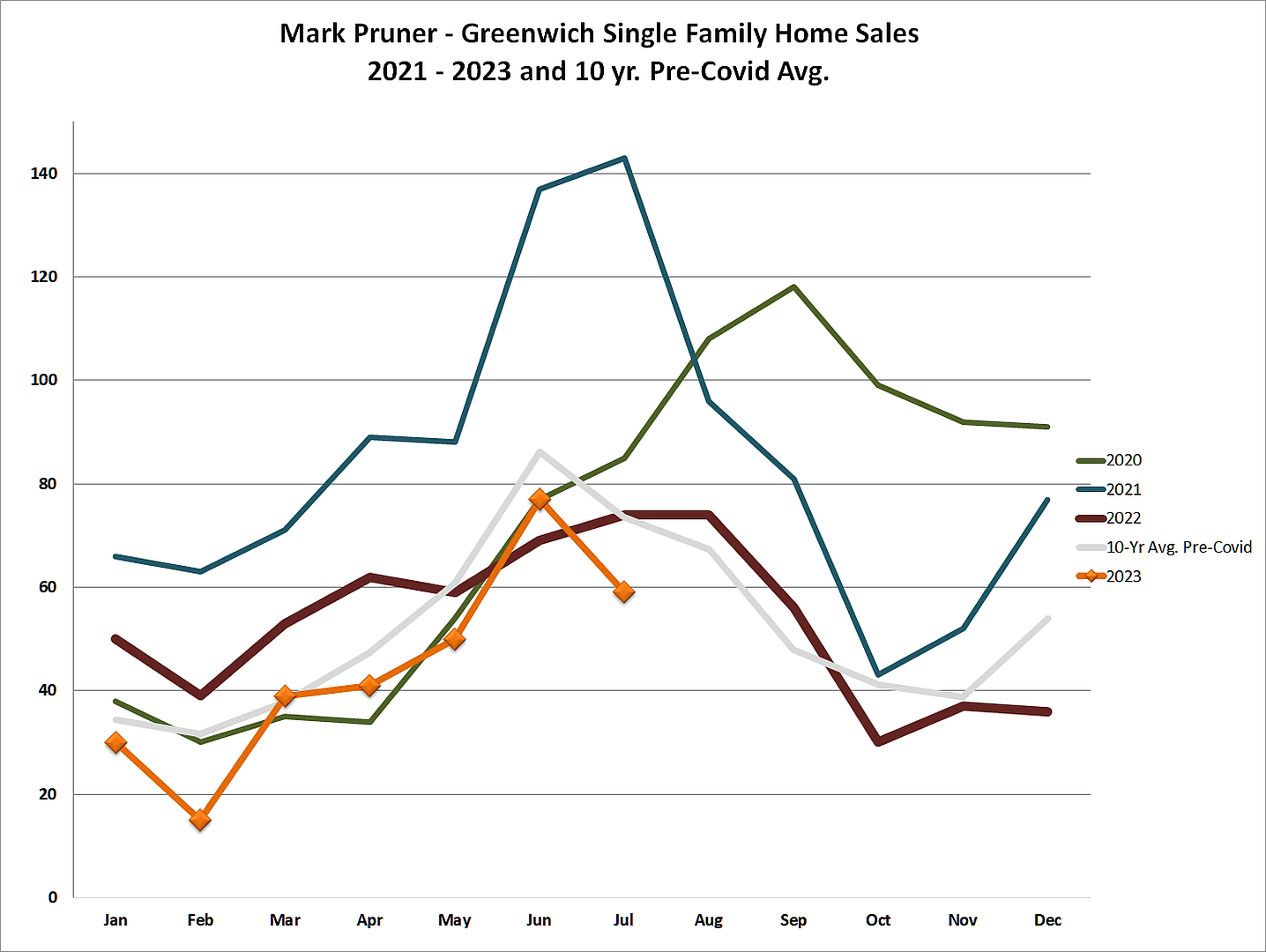

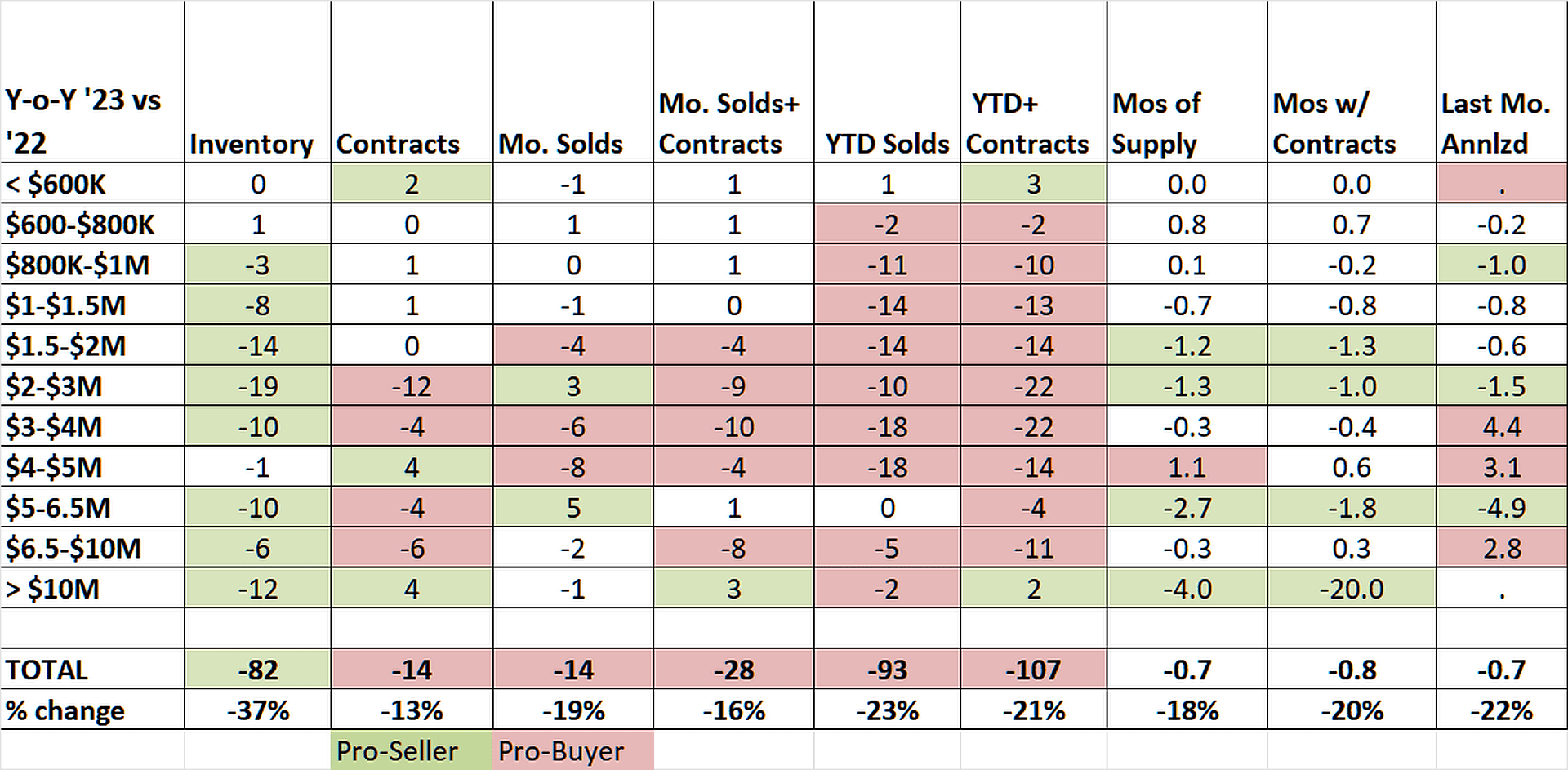

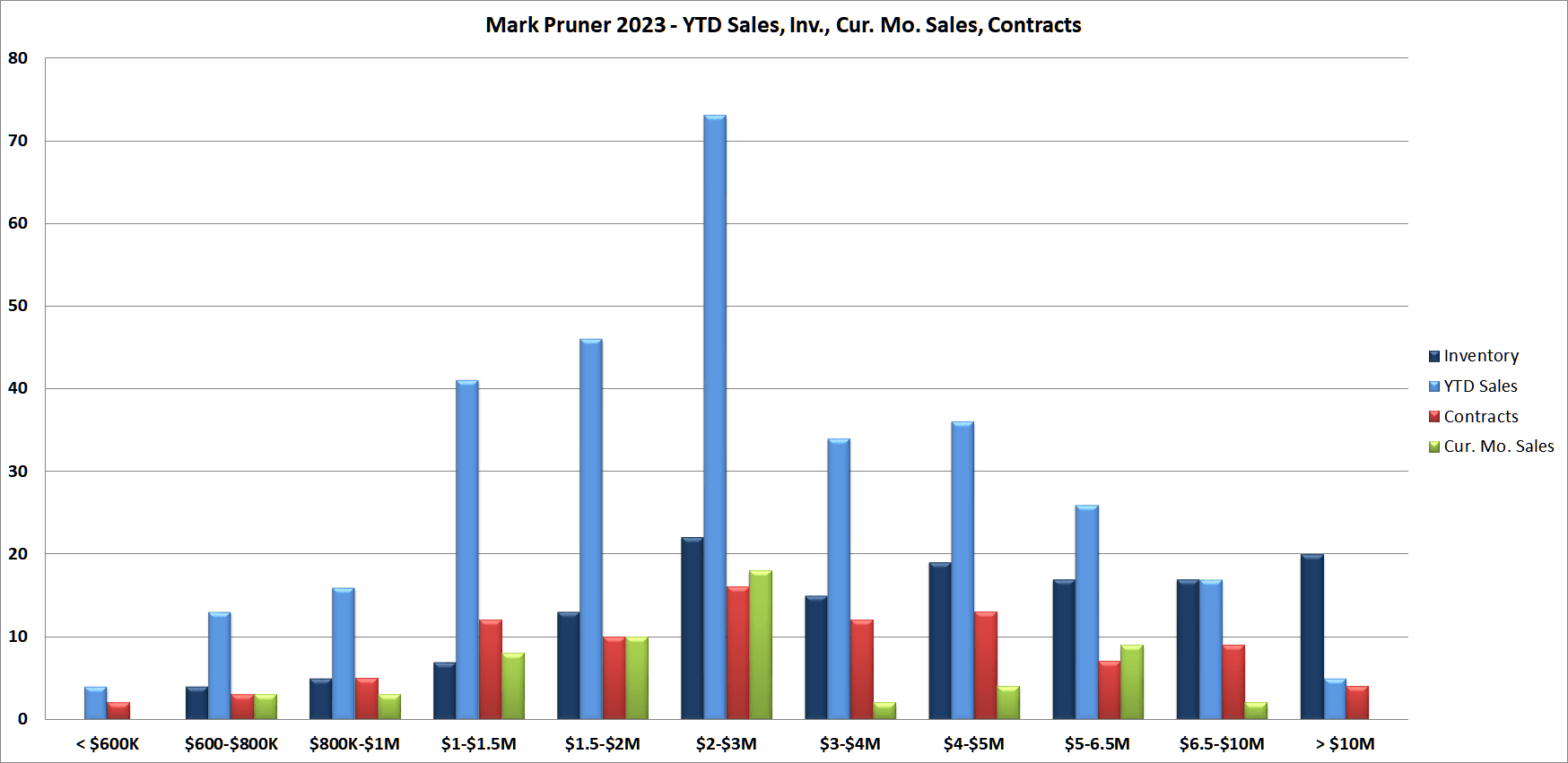

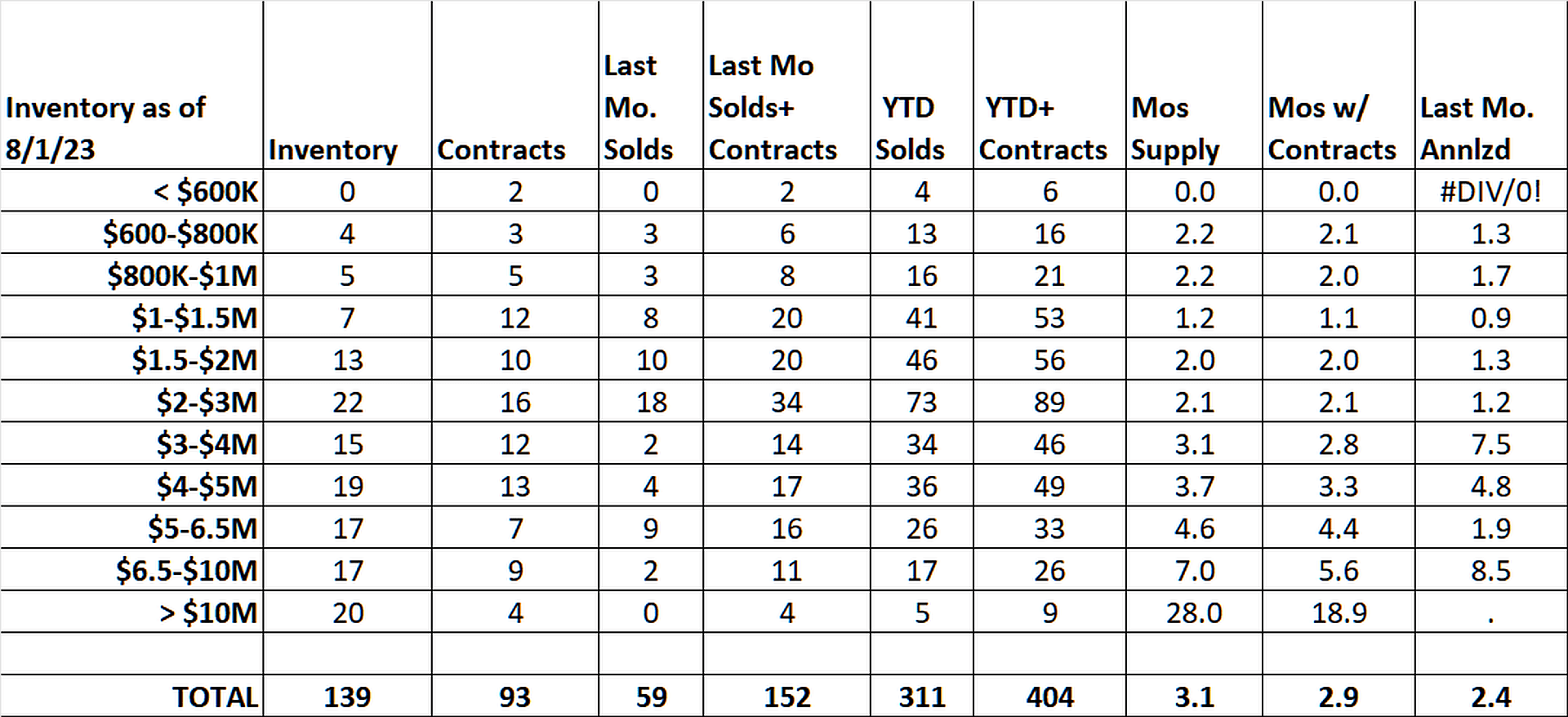

The Pessimist was feeling very positive; positive that the market was terrible. He said, “Our single-family home sales were down 23% over last year with only 311 single family homes sold compared to last year’s 404 sales”. July 2023 was also a bad month for sales with only 59 sales compared to our pre-Covid, average July sales of 74 houses, a 19% drop. The Pessimist just knew that the Greenwich market was going to hell in a hand basket.

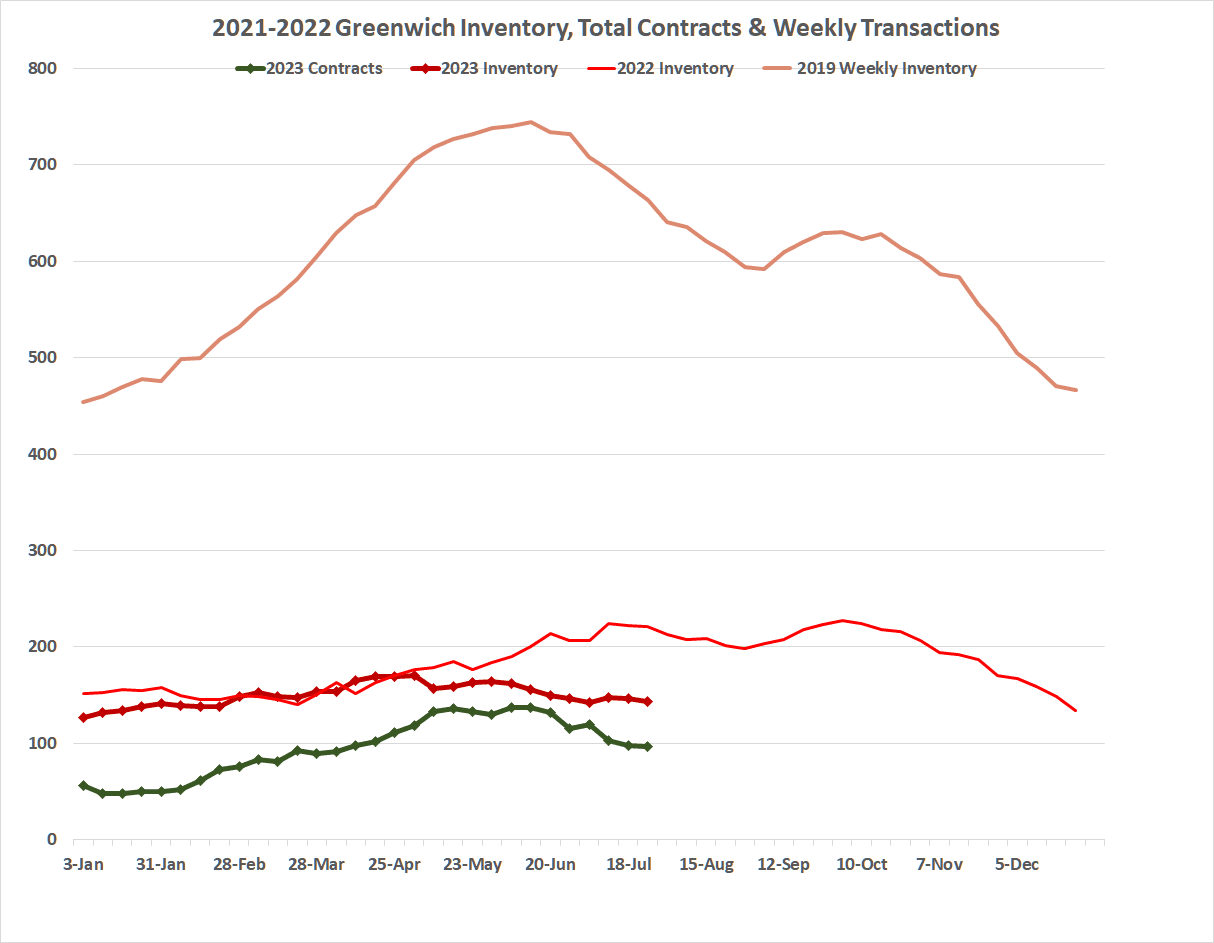

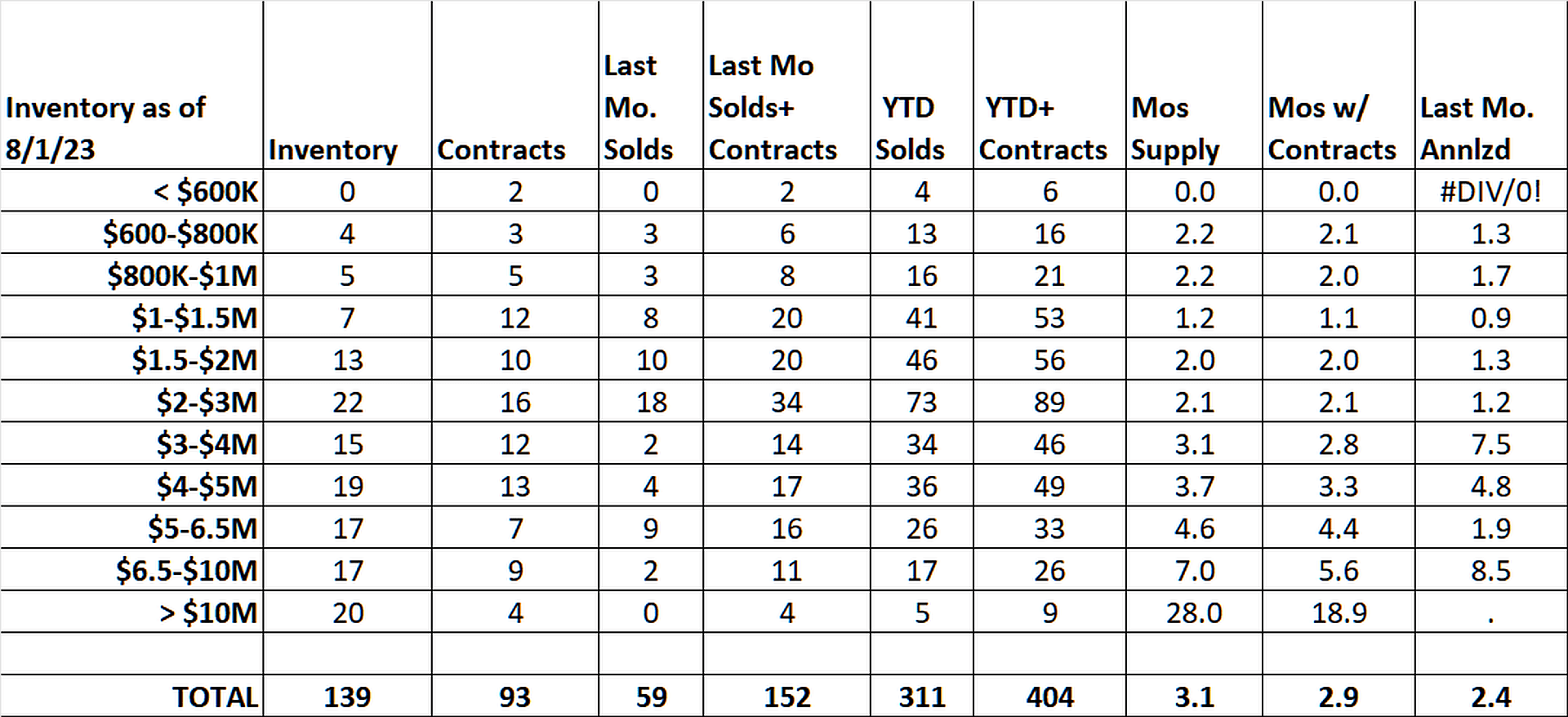

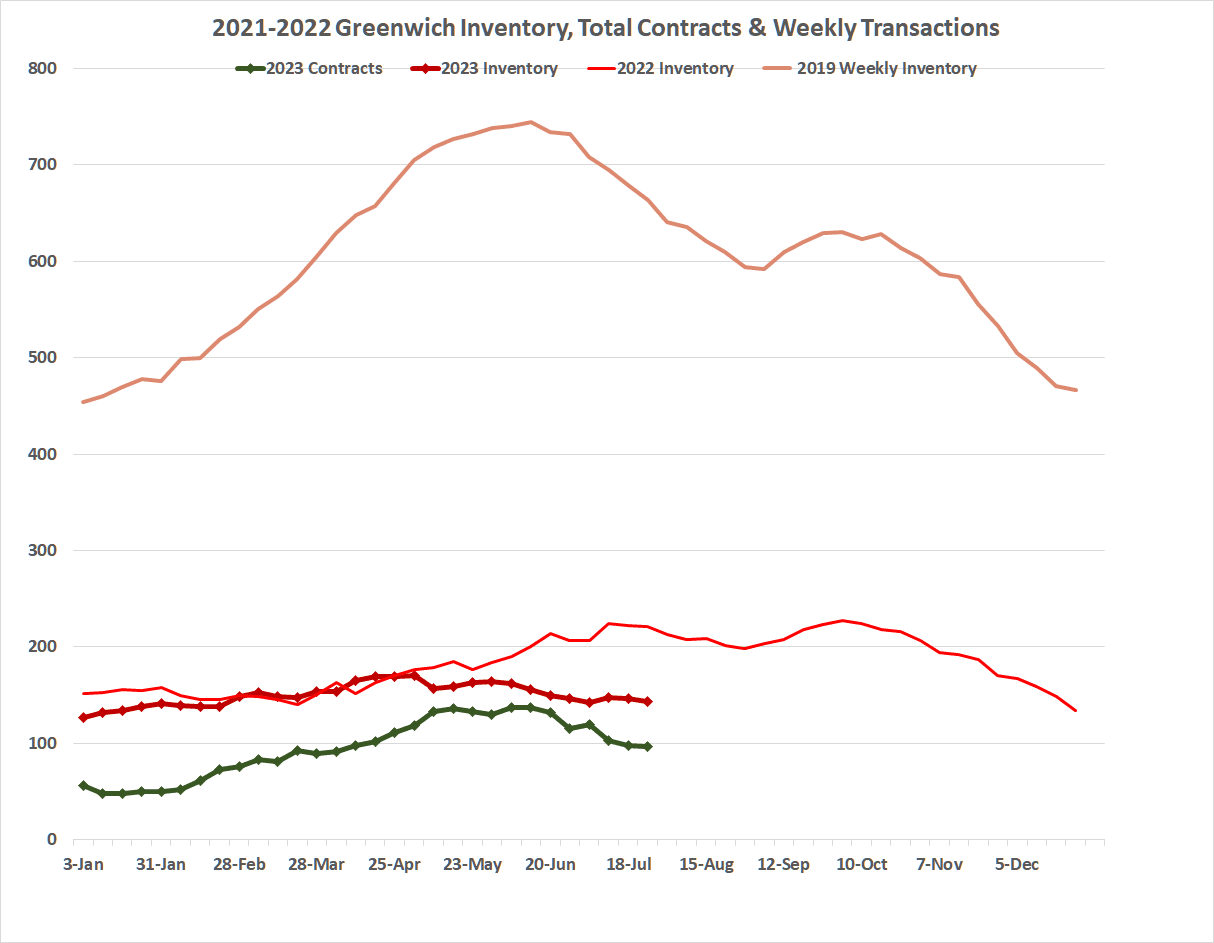

The Optimist chuckled, she told the Pessimist that he was wrong; the market was actually doing amazingly well, given how low inventory was. It was setting new all-time record lows each week with only 139 listings on the market at the end of July. This was down 37% from last year when we already had very low inventory numbers of 221 listings. Come on Pessimist, said the Optimist, pre-Covid in July 2019, we had 640 houses that people could buy. Compared to 2019, we only have 1 house for sale compared to every 4.6 houses that we had for sale in July 2019.

The Pessimist smirked, down is down and it’s not just unit sales that are down, but total dollar volume. So far this year we haven’t even sold a billion dollars’ worth of houses. As of the end of July our total single family home sales are $959 million. Compare this to just two years ago when by the end of July 2021, we had already sold $1.986 billion of houses. We are down by $1.027 billion in sales. In fact, the drop in sales from 2019 is more than we have sold this year.

The Pessimist groaned that this drop has huge ramifications for the Greenwich and the Connecticut economy. Not only have sellers received over a billion dollars less in their pockets, but so have dozens of other industries in Connecticut. Plumbers, carpet sellers, contractors, architects, pool companies and dozens of companies that benefit from sales of property are receiving a lot less money than they were receiving just two years ago and that’s not to mention realtors. Government revenues are also down with town and state’s conveyance taxes down by millions of dollars.

The Optimist looked at the Pessimist and shook her head saying you can’t know that. The contractors and pool companies I’ve talked to have said they are still swamped with carryover business from the boom years of 2020 and 2021. Also, to get back to your billion dollar drop, that is not a valid point. Yes, mathematically our sales are down by that much, but that level of sales was unsustainable.

Actually, the reason we have low sales now, mused the Optimist, is because we had high sales in 2020 and 2021. In those years, you could hear a great sucking sound as inventory that should have come on in 2023 got listed and sold. Our future inventory was being sucked up by 2020 buyers’ demand and sellers pent up supply as the market still hadn’t recovered to pre-Great Recession levels prior to Covid. This shadow inventory meant we had enough listings to fuel record sales of 864 houses sold in 2020, only for that record to be broken in 2021 with 1,007 houses sold.

The Pessimist gloated and shouted down is down! The number of sales is down, the total volume of sales is down, and inventory is down. Not only that, but prices are down, months of supply is down and days on market are down.

The Pessimist gloated and shouted down is down! The number of sales is down, the total volume of sales is down, and inventory is down. Not only that, but prices are down, months of supply is down and days on market are down.

The Optimist smiled with her rejoinder. Half of those “downers” actually show a strong market, not a bad market and our prices aren’t down. The Greenwich sales price/sf is now $702/sf; this is up 6.2% from last year’s $661/sf. So Pessimist, let’s make the same comparison you did, comparing your down year of 2023 to the boom year of 2021. In July 2021, our median sales price/sf was $591/sf or 15.8% lower than it is today, not bad for a “down” market.

With a grin, the Optimist said, and next month our average sale price increase is going to blow you Pessimists with a 70% plus average sales price increase in one month. The sale of Copper Beach Farm’s fifty-acres on the Sound for $133,830,000 means our average sales price is going to jump 72% from $3.083 million to $5.313 million in one month.

The Pessimist grimaced, and said, “Now who’s cherry picking numbers!” Just because one property sold for an all-time record doesn’t mean the overall market isn’t going down. Well OK, maybe prices aren’t going down, but months of supply and sales are going down.

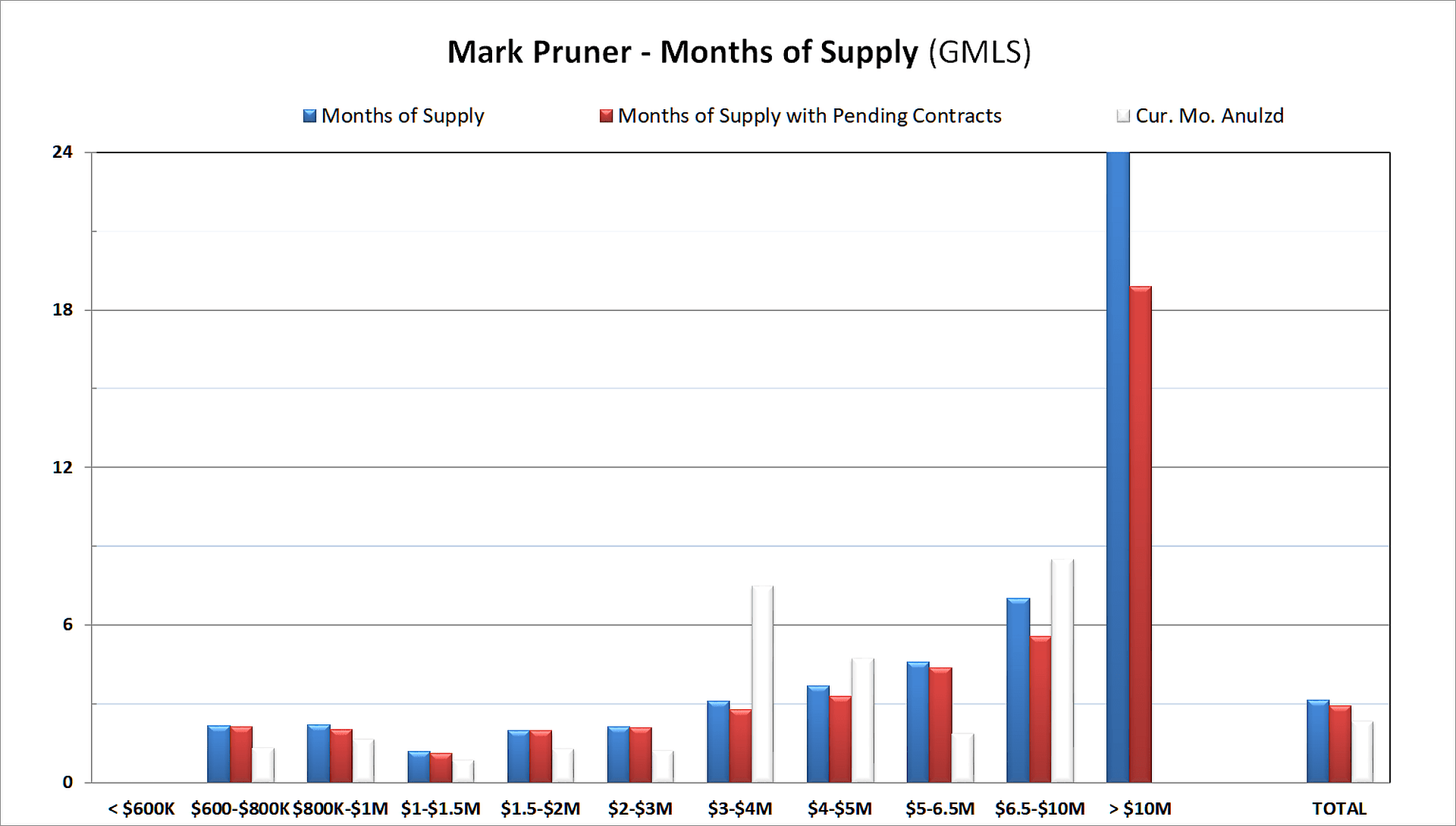

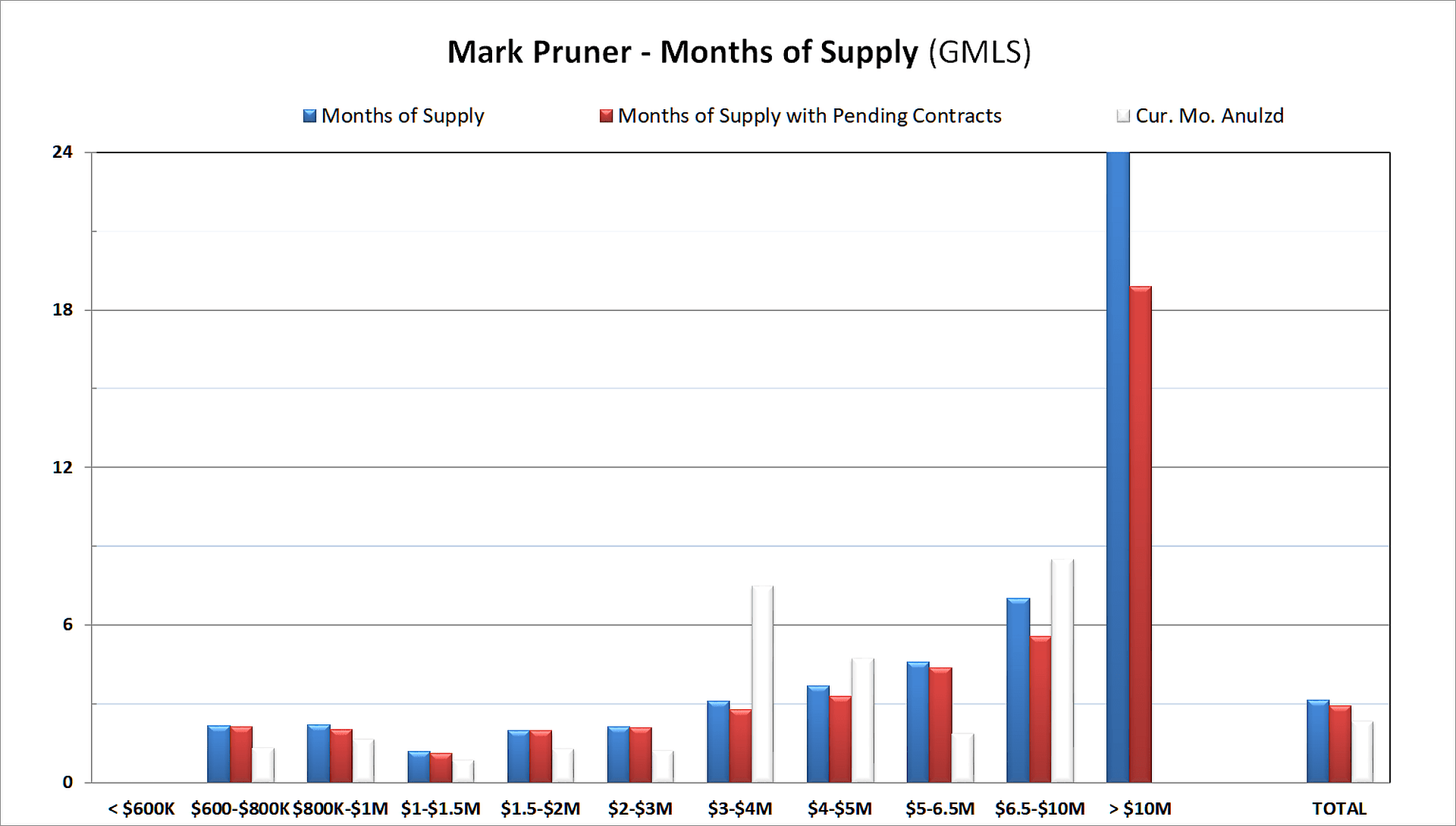

The Optimist countered that if sales are going down, then months of supply should be going up not down as it takes longer to sell the inventory we have at a slower rate of sale. The only way that sales can go down and months of supply can go up is if inventory is falling faster than sales. Pessimist, you are also confusing months of supply with days on the market.

Our months of supply is now at 3.1 months of supply compared to July 2022’s month of supply of 3.8 MoS. At the same, our median days on market is down to only 32 days on market; i.e. half of our house listings are going to contract in less than 32 days. Last year that number was 38 days on market; an active market is an active market.

By this point the Optimist and the Pessimist were feeling tired, and they didn’t agree on much, they did agree that when inventory was so extraordinarily low, you could cherry pick numbers to slant your story either way. They both agreed, it was tough on buyers out there with higher interest rates and little new inventory coming until after Labor Day, it might be a good month to take a vacation.

Then the Optimist piped up and said, “Just think if you were to list a house in August that was in in good shape at a fair market price, it would go in days and for full list price or well over list price just like 44 of the 59 houses that sold in July. Even better, the Optimist thought, imagine if it was like 6 Shady Brook Lane, which listed at $1,995,000 and sold for $2,600,000 after only 9 days on the market.

By then the Optimist noticed that the Pessimist had fallen asleep and decided it must be exhausting to always be a Pessimist.