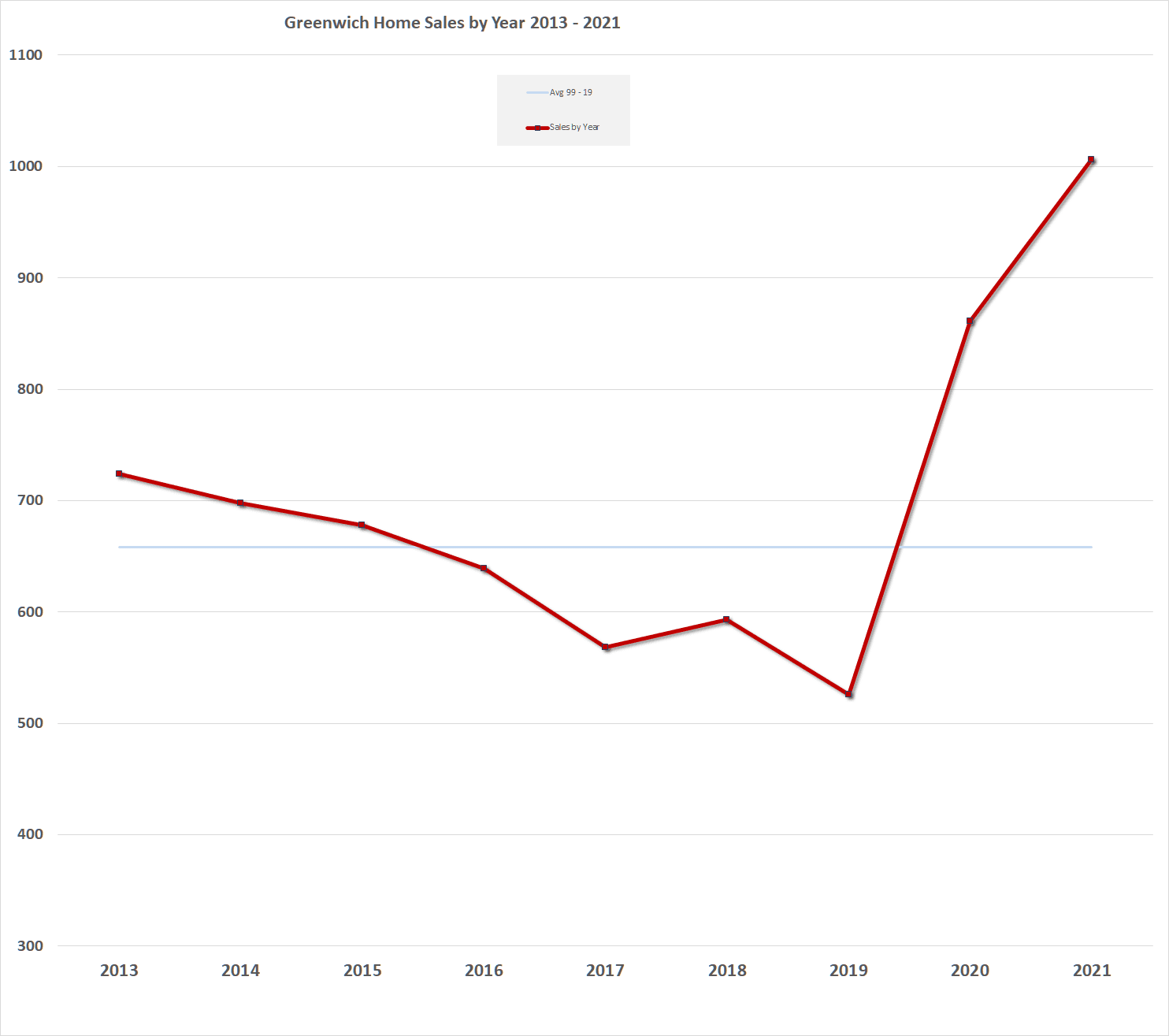

In April 2019, things were not looking good for the Greenwich real estate market. We were in the sixth year of declining sales, and this was after we had recovered nicely from the Great Recession. The Great Recession caused an all-time sales low of 370 home sales in 2009. By 2013, we had recovered to 724 sales: an impressive recovery in only 4 years and well above our 10-year average of 650 homes. We then had a steady decline for five of the next six years.

We dropped from 724 sales in 2013 to 526 single-family homes sales in 2019, a drop of 27%. With the exception of 2018, it was a steady, almost linear, drop. Greenwich, and in particular, north Greenwich had fallen out of favor.

The exception year was 2018, which perked up 4.4% due to the Trump tax bill that limited SALT deductions to $10,000. As a result, tax costs in Westchester County jumped by around 30%, or whatever the taxpayer’s marginal tax rate was. At the same time, the $10,000 limitation on SALT deductions also encouraged Greenwich homeowners, like Westchesterites to relocate south, just not as many. We got a net 25 more Westchesterites moving into Greenwich than we had Greenwichites moving to Florida. By 2019, the decline had resumed with 67 fewer sales, than we had in 2018.

The first quarter of 2020 had a slight uptick, and, then came Covid with all its knock-on effects. That year was a record year that only stood for one year. We had an all-time record in sales in 2021 and we would be having a stellar year this year if we had more inventory.

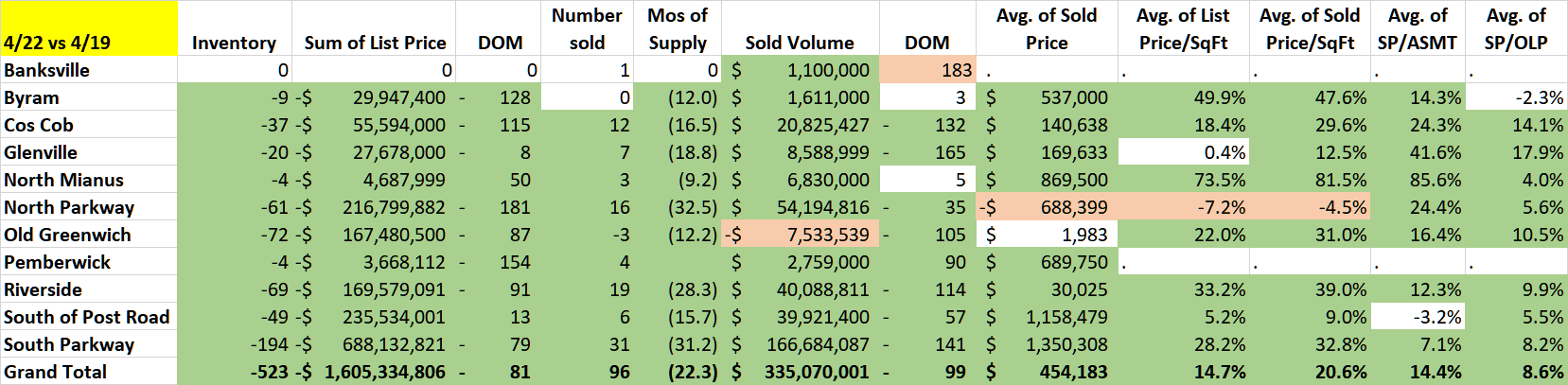

A Quick Look at the Overall Greenwich Real Estate Market in 2022

Our sales are down this year from last year, but up almost 100% from April 2019. Sales are down because we are at all-time record low inventory. Both our months of supply and our daily experiences as Realtors trying to find a home for multiple buyers, say that we have a highly competitive market all the way up to $5 million (and if you add in contracts, it’s not till you get over $10 million, that you have a buyer’s market.)

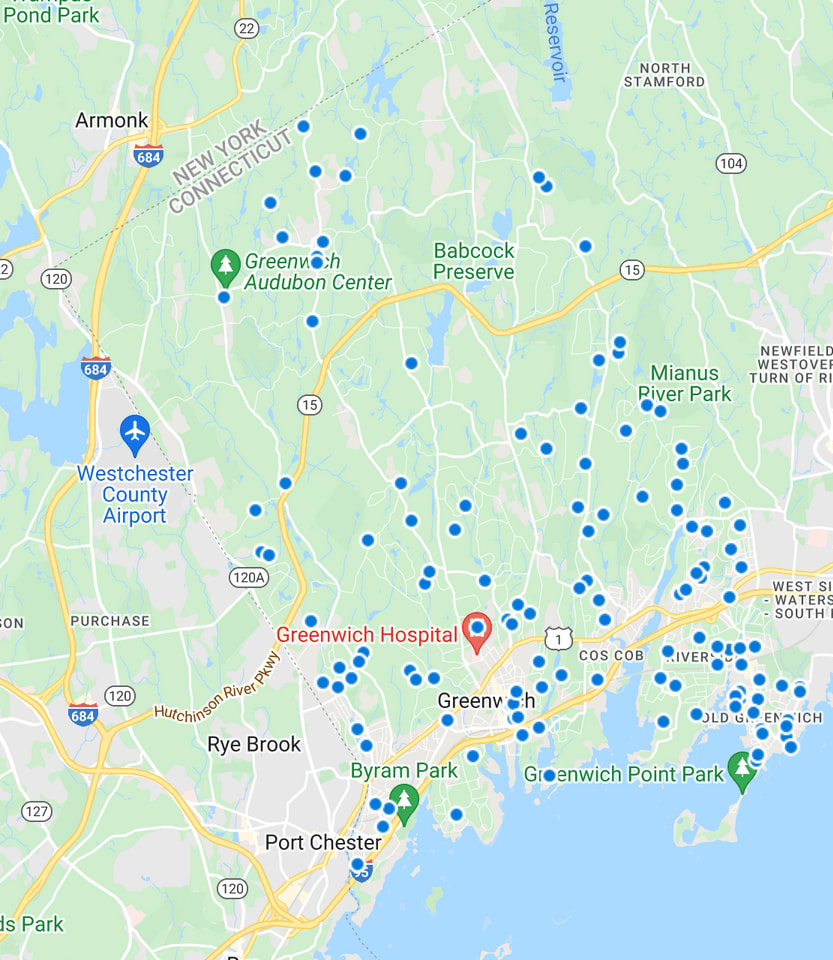

April 2019 YTD – 108 Sales

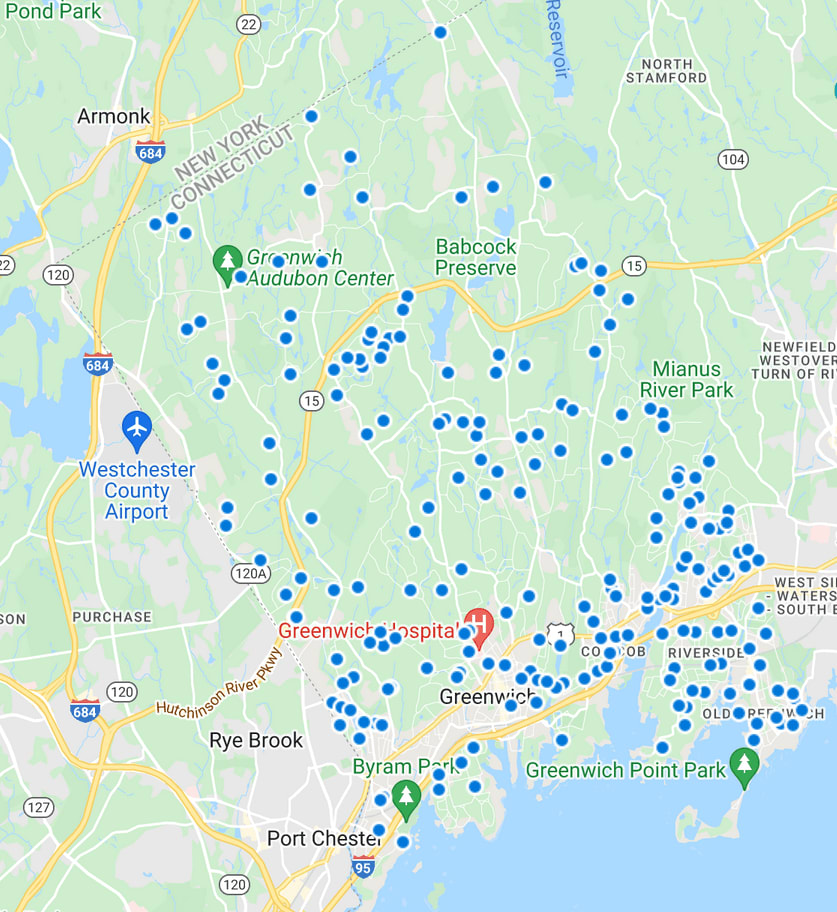

April 2022 YTD – 204 Sales

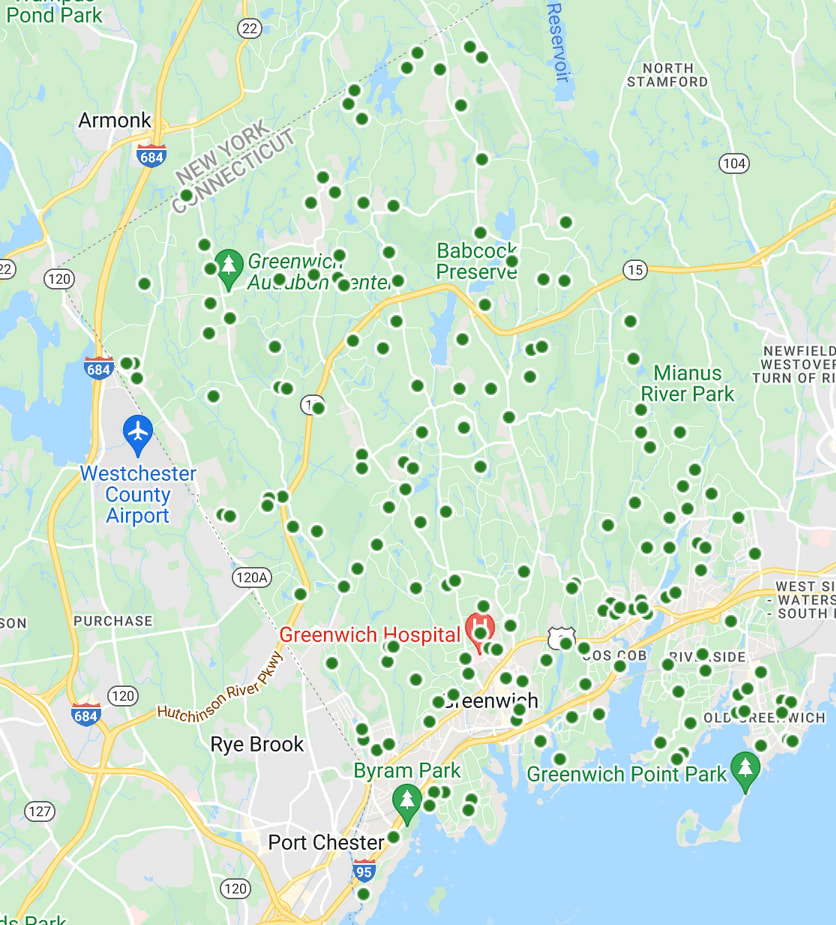

By the end of April 2019, we had had 108 sales, or only 53% of the 204 sales that we had in the first four months of 2022. These sales were also predominantly in the southern half of the town. This year we have had 204 sales and they are distributed throughout the town.

2022 Price Appreciation

The thing that everyone wants to know is how much more is their house worth this year compared to last year. So, let’s take a look at price appreciation, the most misused number in real estate.

Average Sales Price, Median Sales Price – The Backcountry Example

To illustrate why price appreciation numbers can be misleading let’s take a look at what happened to backcountry prices between 2019 and today. What’s at first surprising is that the average sales price in the backcountry actually dropped from $4.55 million in 2019 to “only” $3.86 million so far this year. The average price of a house in the backcountry didn’t go down 15% from 2019, it actually went up and probably around 24% or move over the last three years.

We’ve got three measures of price appreciation and they come in two flavors, median and mean. One way to calculate the average increase in the sales price from one year to another is to compare the average sales price from this year to last year’s average sales price.

It is the easiest to calculate and the most affected by the mix of what is selling especially if there are a few very high sales or a lack of them the following year. This is what happened in 2022. Our average dropped, but this was due to lots of sales under the average price as we had a surge of young families into the backcountry. Our average backcountry price last year was also higher, because of a few very high-end sales.

The median price (half of the sales above and below) is better, but it is also affected by the mix of what is selling and the law of small numbers, which causes calculated amounts to change significantly, with only one or two more sales.

Sales Price/SF or Sales Price/Assessment

Besides average and median sales prices, the other two price appreciation statistics are sales price/sf and the sales price to the assessment ratio. The latter is usually the better statistic if you are trying to minimize the effect of a change in the mix of what is selling.

In 2019, our median sales price to assessment ratio was 1.285 or below the 1.428 ratio, there is no change in the sales price. This 1.428 ratio comes about, because, the Town Assessor, by law, assesses property at 70% of FMV for tax calculation purposes. The reciprocal of 0.7 is 1.428, so the 2019 SP/Assmt ratio of 1.285 meant that backcountry sales price had actually dropped 10% from the last reassessment done on Oct. 1, 2015. Our present backcountry median SP/Assmt ratio is 1.82 which is 41% more than the 2019 SP/Assmt ratio of 1.285.

That seems high and it is. We only had 24 sales in the backcountry in the first four months of this year, so the law of small numbers kicks in. That law says only a couple of sales can make a dramatic difference and that is so here. If you drop to the next highest backcountry SP/Assmt ratio, it is 1.64, so you get an appreciation of 27% from 2019 to April of this year.

This looks more representative of what actually happened as it is similar to the increase in the median backcountry price which went up 31% from 2019 to April 2022. The 1.82 and 41% appreciation are mathematically more accurate, but it is not more representative of what is actually happening in the market.

Overall Price Appreciation in Greenwich

For the town overall, we saw

-

the average sales price goes up 18%,

-

the average sales price/sf goes up 20%, and

-

the average SP/Assmt ratio goes up 14.4%.

Bottom line, take any real estate appreciation figures in Greenwich with a grain of salt. Your house may have done better than “average” or maybe not as good, but the thing you can be pretty sure of is it did go up, by double-digit percentages, regardless of which neighborhood you are in.

If you really want to know how much your house went up contact a Realtor (my numbers below or an appraiser. Sellers and Realtors have done pretty well in estimating sales prices. So far this year, the ratio of the sales price to the original list price is 97.6%. This is also an indicator of how strong the market is as this ratio was 88.1% in 2019.

Backcountry & Mid-country

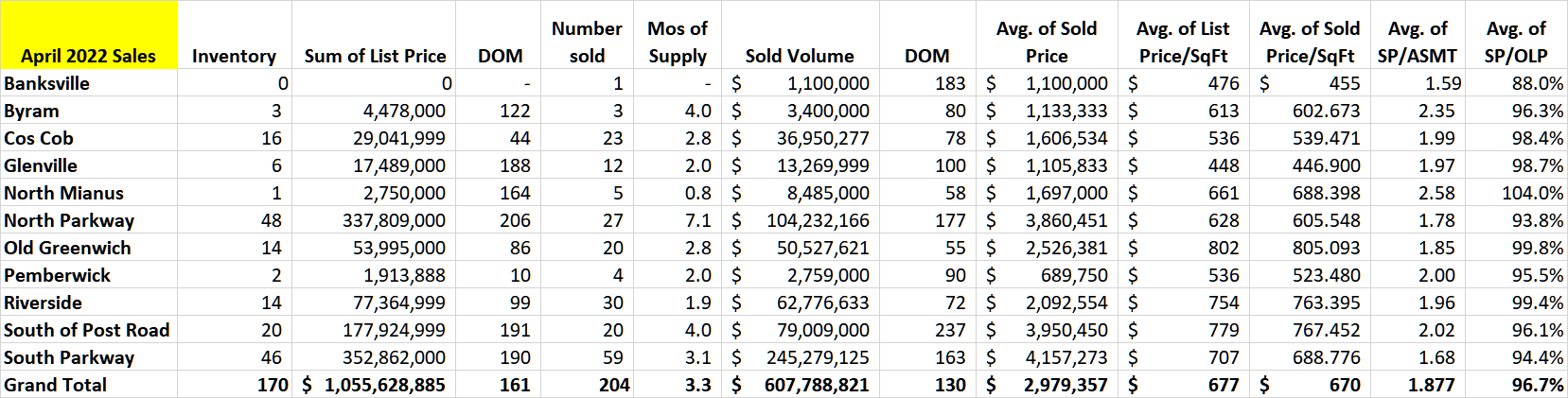

In 2019, we only had 11 sales in backcountry and only 9 sales in mid-country in the 2-acre zone just south of the Merritt Parkway. This year we have had 27 sales in backcountry and 39 mid-country sales in the 2-acre zone, which seems to be the Covid sweet spot, combing a good amount land, a larger house and better proximity to downtown Greenwich.

Greenwich 2022 YTD Sales as of 4/30/22

The 27 sales in backcountry this year totaled $104 million dollars compared to only $54 million in sales in 2019. As of the end of April 2022, we only had 48 listings in backcountry compared to 109 listings in 2019.

Increased sales and decreased inventory led to a dramatic drop in months of supply. We’ve gone from 3.5 YEARS of supply in 2019 to 7 months of supply in 2022. Our contracts are also doing well with 11 backcountry contracts waiting to close.

Greenwich 2022 YTD Sales versus 20219 Sales as of 4/30/22

Now 2022 has not been a perfect year backcountry and northern Greenwich sellers. The one area that shows a balanced, and even a pro-buyer, market is the market over $5 million and backcountry has half of those listings.

Townwide, we are looking at 7.2 months of supply from $5 – 10 million and 29 months of supply over $10 million. We saw the same thing last year, when we had the same 7.2 months of supply from $5 – 10 million and 28 months of supply over $10 million. Mostly, this is because high-end sales have shifted to later in the year, so the high-end is slower, but it looks to be more of seasonal issue.

Greenwich Inventory as of 5/11/22 – 177 Single Family Homes – Down 75% from April 2019

The 7.2 months of supply in the backcountry, is an amazing drop, but it is the highest of any neighborhood in Greenwich. Much of this is due to the fact that the largest portion of high-end listings is there.

South of the Post Road

The next highest months of supply, with 4.0 months, is south of the Post Road where we also have a lot of high-end properties (think Belle Haven, Mead Point, and Indian Harbor). South of the Post Road also includes Chickahominy and the east side of Elm St, two of our more affordable areas where sales are going fast. Average three high-priced areas with two more affordable areas and add in all of the new construction around downtown and the numbers are a blend and not that indicative of any price range in this area.

The good thing is that, in general, the numbers for all price points in this area point to a tight market with high demand, whether they are waterfront properties in gated communities or older houses on 0.17 acres within walking distance to the Avenue. In April 2019, there were 69 houses in inventory, now there are only 20 houses for sale.

Like Byram and Pemberwick, the affordable areas have seen some of the most appreciation in the last three years. So much so that we have no listings under $1 million and only 4 houses listed under $2 million. We actually have more houses listed over $15 million (5 houses) than we have under $2 million.

Not everything sells immediately. In fact, townwide, 60% of houses take more than one month to get to contract, some take much more time. Of 20 houses that are presently listed, 7 of them have been on the market for more than a year and these slow sellers are not just at the high-end.

As to sales, we’ve had 34 sales this year compared to 14 sales in 2019. Of those sales, 2 were under $1 million and 8 more were under $2 million. We had 5 sales that had been on for over 300 days and 4 of those five long-time sales were under $2 million.

South of the Parkway

This is our largest area in town running from the Merritt Parkway to the Post Road. Inventory here shrunk from 240 listings in April 2019 to only 46 listings this year. At the same time, sales more than doubled going from 28 houses sold three years ago to 59 houses this year. This meant that months of supply went from almost three years of supply (34.3 months) to 3.1 months.

The average price also went from $2.81 million to $4.16 million an increase of 48%. Now much of this was Covid buyers wanting much larger houses than the average buyer bought in 2019. The result was that total sales volume soared from $78.6 million to $245.3 million. That certainly helped the town’s conveyance tax collections. (BTW: The increased Gold Coast conveyance tax for sales over $2.5 million gets rebated if you stay in Connecticut for three years.)

Old Greenwich & Riverside

In Riverside, the public listings were about the same going from 83 to 14 listings with sales going from 11 sales in the first third of 2019 to 30 sales YTD in 2022. The days on market dropped from an average of 189 days to 99 days on market. The months of supply went from 303 months of supply to 1.8 months of supply. The lowest of any of our larger areas.

Sales volume actually fell in Old Greenwich from 2019 to 2022 from $58.1 million to $50.5 million. This is what happens when inventory drops from 86 listings to 14 listings. Sales numbers fell from 23 sales in the first four months of 2019 to 20 sales in the first four months of 2022. This “drop” is actually deceptive as the market was so hot in OG, that a bunch of listings never made it to market.

Of the 20 sales reported on the Greenwich MLS, 4 of them were for reporting purposes only, i.e., they were sold off-market and were reported with zero days on market. Reporting off-market is voluntary and I know of other sales that were sold off market either by agents or by the owners directly and there isn’t a record on the GMLS of the sale.

As of May 1st, the Greenwich MLS rules have changed so private listings and listings that are not yet active are much more closely regulated. Private listings will have to stay private for at least 4 months unless the listing broker pays $1,000 to bring it to live earlier. Listings that are being prepared to go live can be held in “delayed” or “coming soon” status, but showings aren’t allowed until the listing is put live.

Cos Cob

House prices went up substantially in Cos Cob with the average price/s.f. going from $416/sf to $603/sf or an increase of 29.6%. The sales price to assessment ratio went from 1.56 to 2.35 the highest sales price to assessment ratio in town and a 24.3% appreciation. (North Mianus was actually higher at 2.58, but that was based on only 5 sales.)

The big quandary is inventory and how much the increase in interest rates and the drop in the stock and bond markets are going to affect market demand. Stay tuned.