A Third Record Year, a Slump, or Déjà Vu?

Where Are We Now?

Sales and Listings

To know where Greenwich real estate is going, it helps to know where Greenwich real estate is now. As of the first week of December 2021, we have had 950 single-family home sales. The question isn’t however, whether we will break 1000 sales, we have already easily exceeded that number. The reason is that 20 to 25% of our sales are usually off-market and this year we are at the upper end of the range. I, and every other agent with a motivated buyer, are constantly asking other agents whether they have or will be getting a new listing. This year, lots of buyers, have been thanking their agents for “finding them the house, that no one else could find.”

As to public listings sold, we are right now looking at a year-end total of 990 sales made on the GMLS, if we have a normal 57 house sales this December. We may, however, break the 1,000 sales mark; It will be close. The demand is there, but what may prevent it is our falling under 200 listings. Right now, we are at 199 house listings on the GMLS and December is a time for sales and not new listings.

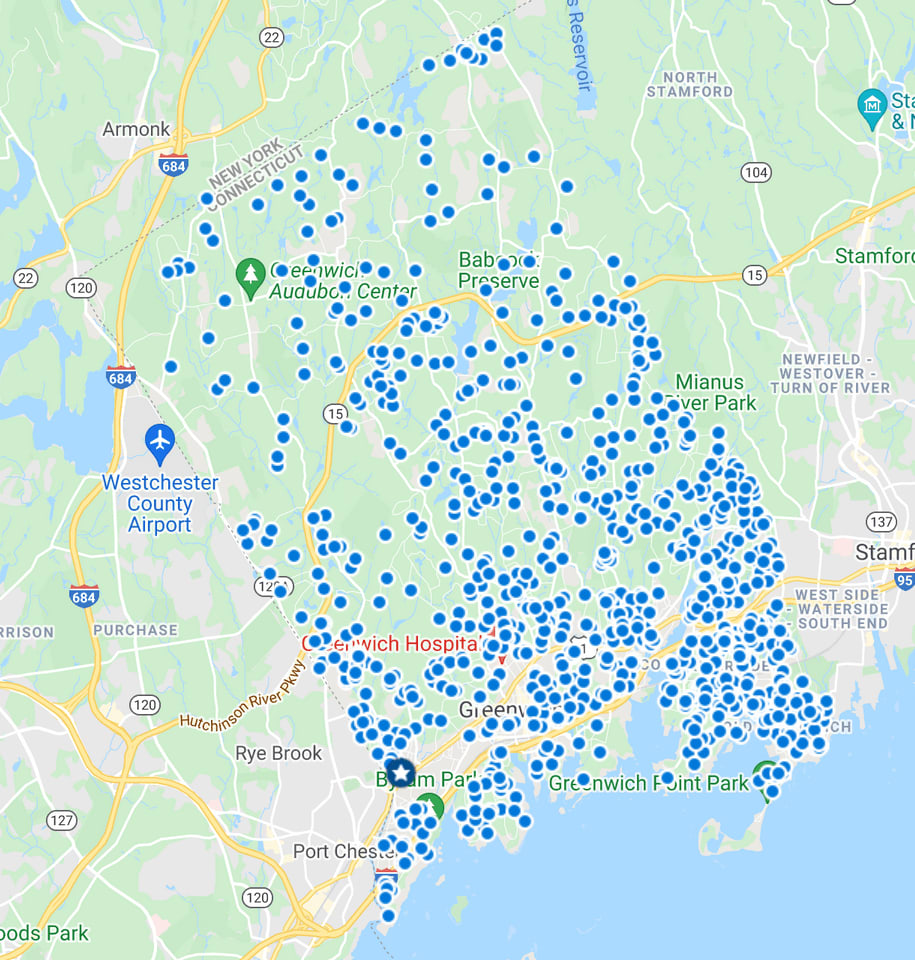

950 YTD house sales in Greenwich 11/20 (Note, concentration of sales along the western and northern border with NYS)

Contracts

On the contract side, we presently have 109 contracts which is a significant drop from the 121 contracts that we had at the beginning of the month. In total, we have 1071 single-family homes sold or under contract so far this year.

Where Are We Going In 2022?

The big problem with black Swan events, like COVID, does not only do you not expect them to happen, but when they start to die out it’s equally uncertain what will follow. We don’t know even know whether the increasing positivity rate that we’re seeing primarily from the delta variant will continue to get worse as the cold weather drives people indoors. If you look at the map of where COVID has gotten worse, it corresponds to where we are seeing our coldest weather. Our positivity rate bounces around, but it is going up, not down, as we see more cold weather in Connecticut.

Clearly, 2022 is not going to be a repeat of 2021 and certainly not a repeat of 2020. The pharmaceutical industry is rolling out new vaccines, and new treatments and if you haven’t picked up a home testing kit, they are becoming regularly in stock at our local pharmacies. Personally, I think easy, early and ubiquitous testing will cut into the spread of COVID significantly as people will know much earlier whether they are contagious or not.

The bottom line is, that COVID is going to be COVID and there’s not that much we can do about predicting its effect on the housing market. What is quite clear, however, is that The US economy can do very well with large numbers of people working from home and that large numbers of those people working from home will quit if they are required to go back to 9 to 5, five days a week. Given our labor shortages, companies are going to have to bow to workers' desires to spend more time at home.

WOOFH

As a result, we will continue to see the average house size increase as people need offices and homework areas, so they are not in their bedrooms 14 hours a day. Working occasionally or often from home (“WOOFH”) will mean that where people want to live will change and clearly Greenwich is one of those places that looks better in a post-Covid, WOOFH demanding world. With eight and a half million people in New York City and 22 million people in the metro area, we’re going to see a continuing demand for the larger homes, bigger yards with on-site amenities that Greenwich provides. This bodes very well for the Greenwich real estate market in 2022.

Whither Inventory?

The biggest impediment to 2022 being another record year in Greenwich is our lack of inventory. This is not a Greenwich problem, but a nationwide problem as people want more single-family homes with yards in the suburbs around major metropolitan areas.

(N.B. We are seeing announcements of a major uptick in sales and rentals in many major cities however, these jumps in transactions are often because they are being compared to the dearth of transactions in 2020 when nothing was going on. When you compare 2021 numbers to 2019 these big jumps in sales and rentals often go away.)

Can Our Inventory Go to Zero?

One thing that won’t happen in 2022 is our inventory going to zero. I work with my brother, Russ, here at Compass and he has statistics going back 37 years. The lowest inventory he ever recorded pre-Covid was 290 listings in the last week of 2000. The end of the year is usually when we see our lowest inventory and it’s normally just under 400 listings, not the 199 listings that we have now.

The good thing is that real estate always has new listings being generated by lifecycle changes. People have kids, get married, get divorced, downsize, and pass away. This year in Greenwich much of our inventory has come from people who are upsizing driven by COVID and WOOFH. For each one of those families that bought a bigger house, most also sold their old house or their landlord re-rented their place to one of the many first-time homebuyers. Not many people keep two homes in Greenwich.

What About Zero Listings at the Low End?

Unlike the overall inventory, It is possible, for our listings for single-family homes under $600,000 to go to zero. With our price appreciation, we just don’t see many homes listed under that amount in Greenwich. In 2020, we sold 17 houses under $600K, so far in 2021, we have only sold 8 and only have 2 houses on the market. I expect that next year we will have no houses listed under $600K for many months of the year.

Do We Have Enough High-End Inventory?

The greatest surge in sales this year compared to last year is in our $5 to 10 million price bracket. In that price range, our sales are up 110% over last year and our inventory is down 35%. Given our very limited availability of waterfront lots, I expect to see a resurgence of new construction in mid-country and backcountry as the demand is there from high-end buyers.

Unfortunately, one of the things that are driving sales at the high end in addition to COVID and WOOFH is the increase in crime in New York City. Personal safety is something we all will pay to insure but at the higher price levels being free from personal danger is something that people will spend millions of dollars on. You can expect Mayor Eric Adams to move strongly to lower NYC crime rates in 2022.

Will There Be Enough Money to Buy Greenwich Houses in 2022?

People talk about the cost of goods going up however an economic professor of mine used to say it is equally valid to talk about the value of money going down. With 6% inflation, the $1 that used to buy 100 cents of goods, now only buys 94 cents worth of goods. Traditionally, one of the hedges against inflation has been to shift money from cash, a depreciating asset, into an appreciating asset such as real estate. In 2022, we are going to hear more pundits talk about inflation driving sales, particularly, at the high end.

We also have lots of people sitting on appreciated company stock and on unspent discretionary savings. Both of these are likely to push Greenwich home sales higher.

Will Rising Interest Rates Kill Our Market?

The Fed is expected to let interest rates rise in the first half of 2022. This is way overdue. The Fed has been inflating the economy at a time when they don’t need to do so and it’s pushing up the cost of goods for everyone including the cost of Greenwich houses. Once the stimulus payments are no longer occurring and the Fed is not artificially keeping mortgage rates low you can expect some softening in demand.

However, the National Association of Realtors did a study and they found that periods of rising interest rates were also generally periods of rising inflation encouraging people to buy hard assets. An increase in interest rates may slow the increase in demand but it’s unlikely to stop it. In fact, one thing driving our low inventory is our smart money buying houses with very low mortgage rates, before interest rates go up.

A related factor that will push home sales up is that many more people now have enough for a downpayment since they have been staying home and saving money. (When was the last time you paid $400 for a ticket to a hit Broadway show?) Also, we are in the midst of the greatest wealth transfer ever from the baby boomers and greatest generation to the millennials and Gen Xers.

For more than a century, Greenwich has attracted well-to-do people, whose sources of wealth have varied greatly. We’ve also seen wealthy people come from all over the world to buy in Greenwich. Whether motivated by newfound riches, such as we saw with the OPEC countries in the 1980s, or problems at home as we have seen with various South American countries, people from around the world come to Greenwich.

2022

Are we likely to have another 1,000 single-family home sales in 2022? Personally, I think that’s unlikely. Are we likely to have a year with sales well above 600 sales, our dividing line between a good year and a poor year? That I think is likely.

Stay tuned it’s going to be an interesting year, and hopefully not as traumatic as this year.